Predicting Stock Prices Using Data Mining Algorithms in the Stock Market of Iran

Keywords:

Ensemble Algorithm , Stock Profit Prediction , LSTM , Deep LearningAbstract

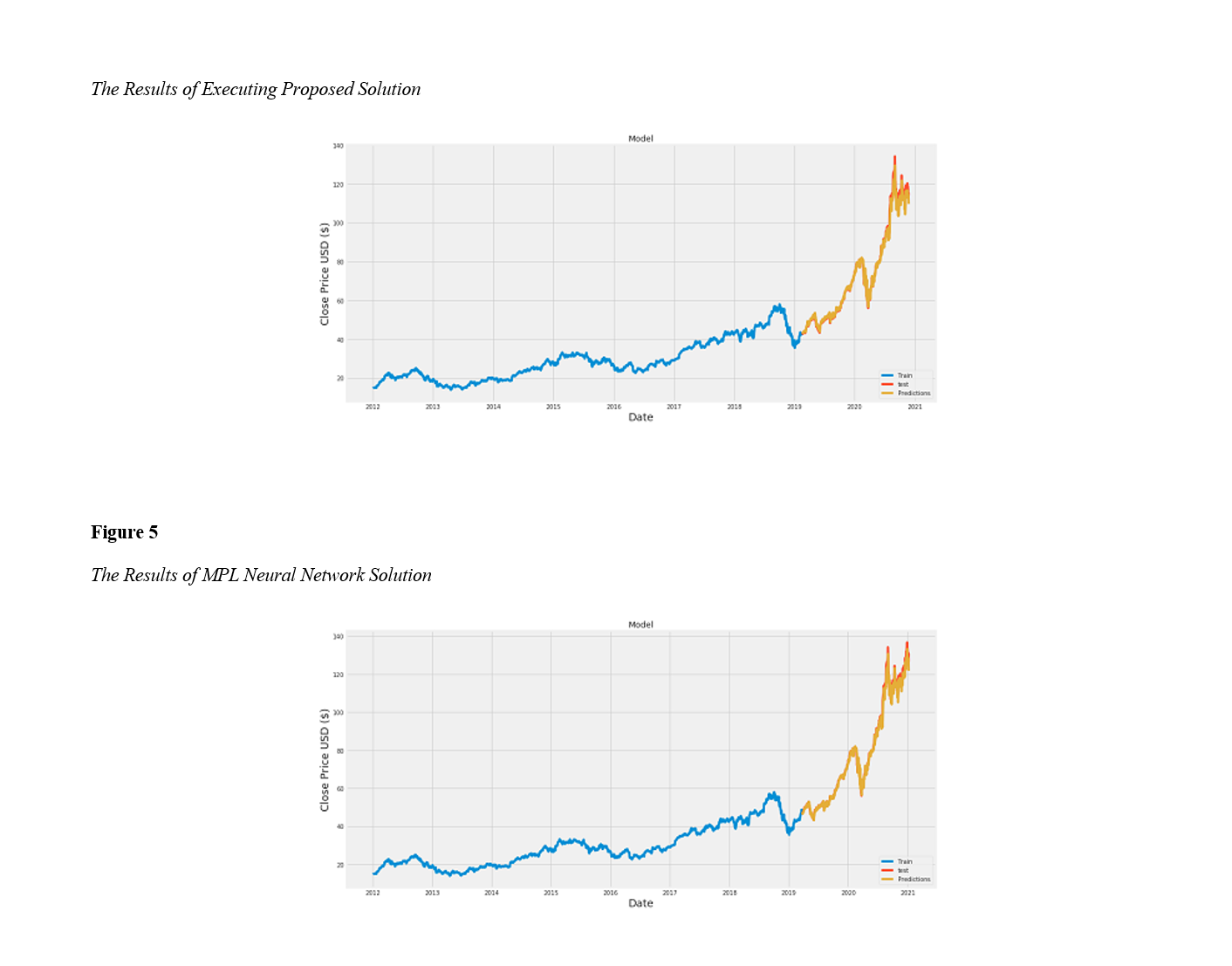

Given the role of the stock market in financial markets, the role of the stock market in the overall financial market is essential. How to predict the actual revenue of transactions and maximize benefits in the trading process has been an issue that researchers and financial experts have long investigated. Deep learning networks can extract features from a large amount of raw data, which has potential advantages for stock market prediction. One of the main advantages of the LSTM neural network is that it can extract features from a large amount of raw data without relying on the predictors' prior knowledge. This makes deep learning particularly suitable for stock market prediction. In stock market forecasting, many factors influence stock prices in complex and nonlinear ways. If there are factors with predictable evidence, these factors can be used as part of the deep learning input data to determine the relationship between these factors and stock prices. Stock return prediction is performed by simulation in MATLAB software with LSTM using GA and PSO algorithms. As a result, stock returns are somewhat predictable, and the initial input level consists of lagged stock returns. The data is presented, and an LSTM neural network is built to predict future stock returns.

Downloads