The Impact of the Digital Sharing Economy on the Saving and Investment Patterns of Generation Z in Iran

Keywords:

Digital Sharing Economy, Financial Behavior, Saving and Investment Styles, Generation ZAbstract

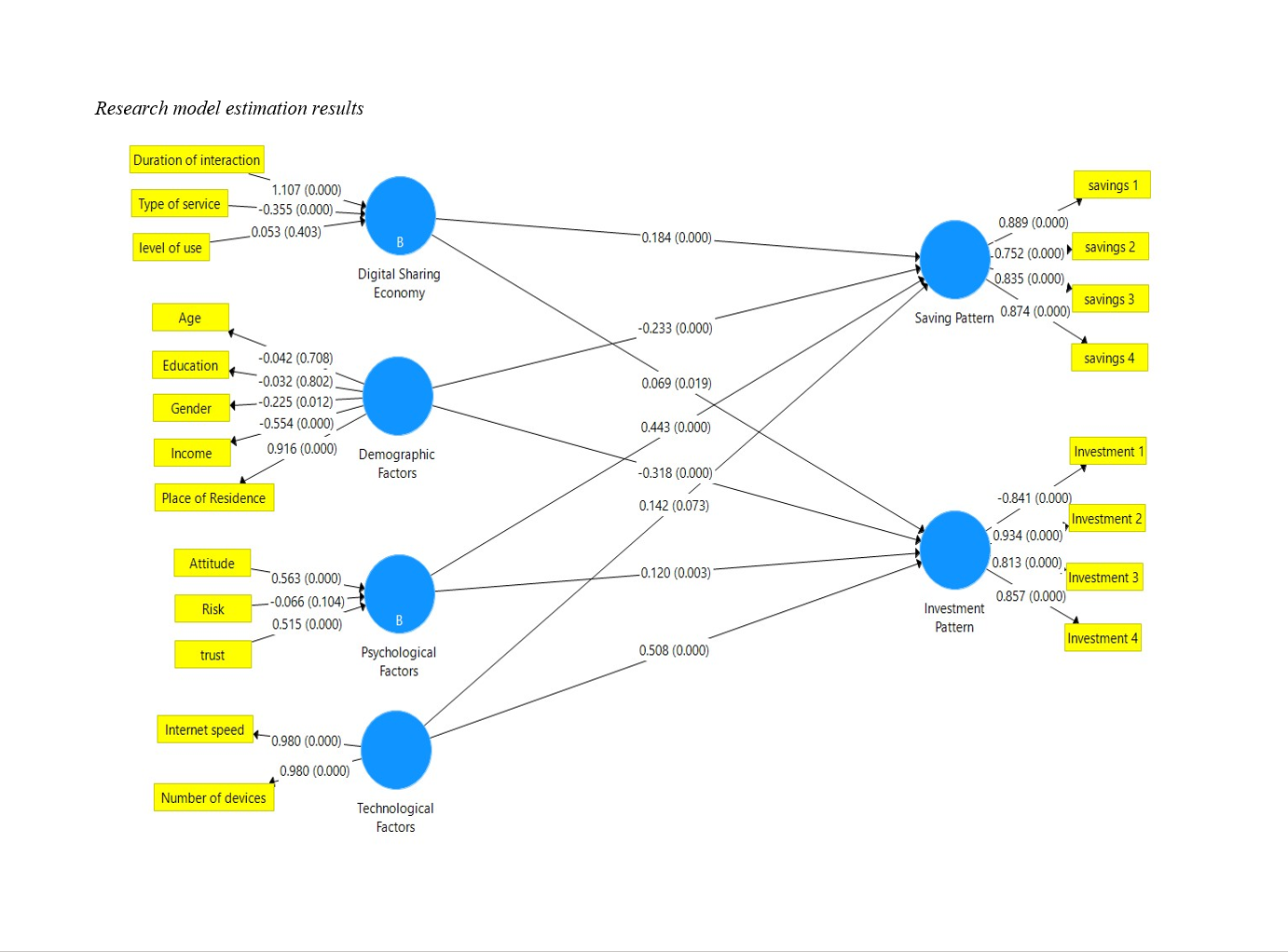

The digital sharing economy, as an emerging paradigm, profoundly shapes the financial behaviors of Generation Z and transforms traditional patterns of saving and investment. This study investigates the impact of the digital sharing economy on the saving and investment styles of Generation Z in Iran, focusing on predictive factors such as psychological factors, technological factors, and demographic variables. The research follows a descriptive correlational design with a structural equation modeling (SEM) approach. The statistical population consisted of Generation Z users (born between 1997 and 2012) of sharing economy platforms in Iran, among whom 384 participants were selected through convenience sampling. Data were collected via a questionnaire with a composite reliability above 0.7 for all constructs and were analyzed using path analysis and standardized coefficients. The results indicated that technological factors were the strongest predictors of risk-taking investment style (β = 0.508), while psychological factors were the most significant determinants of conservative saving style (β = 0.443). Demographic factors showed a significant negative relationship with both investment (β = −0.318) and saving styles (β = −0.233). The digital sharing economy had a weak effect on saving style (β = 0.184) and a negligible effect on investment style (β = 0.069). The model explained 31.7% of the variance in investment style and 42.5% of the variance in saving style. The findings revealed a fundamental duality in the drivers of Generation Z’s financial behavior: investment is technology-driven, whereas saving is rooted in psychological contexts. Contrary to expectations, the youngest members of Generation Z are the pioneers of digital financial transformation, while the sharing economy, despite its quantitative growth, plays a limited role in shaping financial behaviors. These results highlight the necessity of adopting differentiated approaches for promoting investment (through technological infrastructure development) and saving (through fostering trust and education).

Downloads

References

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179-211. https://doi.org/10.1016/0749-5978(91)90020-T

Akbari, S., Gholipour, A., & Nargesiyan, A. (2023). Identifying factors affecting the retention of Generation Z employees in the capital market: Compensation and benefits system. Human Resource Management Research Journal, 15(51), 11-52. https://hrmj.ihu.ac.ir/article_207948_8c740936279b4d57871e0242c4ccd532.pdf?lang=en

Asi, M., Chirani, E., & Farahbud, F. (2022). Examining factors affecting financial literacy based on a native financial literacy model of retail investors in Iran's capital market. Stock Exchange Quarterly, 15(57), 531-578. https://doi.org/10.22034/jse.2022.12102.2062

Aznab, E., Seyed-Amiri, N., Ezami, E., & Ranjbaran, A. (2020). Creating brand image: Examining the role of Instagram users' experience on the brand image of sharing economy platforms. Brand Management Quarterly, 7(21), 3-22. https://www.researchgate.net/profile/Alireza-Ranjbaran-2/publication/351993764_Creating_the_Brand_Image_Investigation_the_Role_of_Instagram_Users_Experience_on_Customers_of_Sharing_Economy_Platforms/links/60b4d00e45851557baaf8b16/Creating-the-Brand-Image-Investigation-the-Role-of-Instagram-User-s-Experience-on-Customers-of-Sharing-Economy-Platforms.pdf

Bai, H., Chen, Y., & Zhang, Z. (2025). Exploring the mitigating role of sustainable innovation in supply chain disruption risks under the digital economy. International Review of Economics and Finance, 103, 104372. https://doi.org/10.1016/j.iref.2025.104372

Bärö, A., Toepler, F., Meynhardt, T., & Velamuri, V. K. (2022). Participating in the sharing economy: The role of individual characteristics. Managerial and Decision Economics, 43, 3715-3735. https://doi.org/10.1002/mde.3624

Champkins, M., & Bocken, N. (2025). Stimulating circulation in the circular economy: A case study of value generation for a resale platform for LEGO bricks. Journal of Cleaner Production, 516, 145505. https://doi.org/10.1016/j.jclepro.2025.145505

Costa-Font, J., Giuliano, P., & Ozcan, B. (2018). The cultural origin of saving behavior. PLoS One, 13(9), e0202290. https://doi.org/10.1371/journal.pone.0202290

Creswell, J. W. (2014). Research design: Qualitative, quantitative, and mixed methods approaches. Thousand Oaks, CA: SAGE Publications.

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 319-340. https://doi.org/10.2307/249008

Davlembayeva, D., Papagiannidis, S., & Alamanos, E. (2020). Sharing economy: Studying the social and psychological factors and the outcomes of social exchange. Technological Forecasting and Social Change, 158, Article 120143. https://doi.org/10.1016/j.techfore.2020.120143

Dew, J., & Xiao, J. J. (2011). The Financial Management Behavior Scale: Development and validation. Journal of Financial Counseling and Planning, 22(1), 43-59. https://scholarsarchive.byu.edu/facpub/4521/

Grable, J. E., & Lytton, R. H. (1999). Financial risk tolerance revisited: The development of a risk assessment instrument. Financial Services Review, 8(3), 163-181. https://doi.org/10.1016/S1057-0810(99)00041-4

Güçlü, M. S., Erdil, O., Kitapçı, H., & Altındağ, E. (2023). How consumer motivations to participate in sharing economy differ across developed and developing countries: A comparative study of Türkiye and Canada. SAGE Open, 1-20. https://doi.org/10.1177/21582440231177040

Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2021). A primer on partial least squares structural equation modeling (PLS-SEM). Thousand Oaks, CA: SAGE Publications Inc. https://doi.org/10.1007/978-3-030-80519-7

Hollimon, L. A., Taylor, K. V., Fiegenbaum, R., Carrasco, M., Garchitorena Gomez, L., Chung, D., & Seixas, A. A. (2025). Redefining and solving the digital divide and exclusion to improve healthcare: going beyond access to include availability, adequacy, acceptability, and affordability. Frontiers in Digital Health, 7, 1508686. https://doi.org/10.3389/fdgth.2025.1508686

Huang, B., Suri, A., Tezer, A., & Sénécal, S. (2024). This is not mine anymore: The dark side of collaborative consumption. International Journal of Research in Marketing, 41, 616-631. https://doi.org/10.1016/j.ijresmar.2024.05.002

Kazemi, A., & Amini, S. (2022). Comparative study of retail investment patterns on digital platforms across generations. Economic Studies Quarterly, 19(2), 125-154.

Khalkhali, A., Banafshaei, M., Heidari, A., Hamidifar, F., & Kamani, B. (2022). Examining the role of digital transformational leadership and digital strategy on urban economic development. Scientific Quarterly of Urban Economics and Management, 112(245), 147-161.

Kordanayij, A., Meshbaki Esfahani, A., & Asghari Goodarzi, F. (2022). Identifying antecedents of value co-creation in sharing economy startups using a mixed methods approach. Entrepreneurship Development, 15(3), 563-582. https://doi.org/10.22059/jed.2022.338680.653893

Lou, G. (2024). Application of network data security based on wireless sensor technology in the development of digital sharing economy. Measurement: Sensors, 33, 101214. https://doi.org/10.1016/j.measen.2024.101214

Mendieta Aragón, A., Rodríguez Fernández, L., & Navío Marco, J. (2025). Tourism usage of digital collaborative economy platforms in Europe: Situation, behaviours, and implications for the digital policies. Telecommunications Policy, 49, 102874. https://doi.org/10.1016/j.telpol.2024.102874

Moradi, M. A., & Hedayati, M. R. (2018). Designing an evolutionary transition model of Iran to the digital economy. Economic Research Letter, 18(98), 219-251.

Naderpajouh, N., Zolghadr, A., & Clegg, S. (2024). Organizing coopetitive tensions: Collaborative consumption in project ecologies. International Journal of Project Management, 42, 102586. https://doi.org/10.1016/j.ijproman.2024.102586

Nicol, C., Kostis, A., Lidström, J., & Holmström, J. (2024). Corporate incubation for platform growth and the transition to platform scaling: Between a rock and a hard place in the circular economy. Technological Forecasting & Social Change, 208, 123651. https://doi.org/10.1016/j.techfore.2024.123651

Ollerenshaw, A., Thompson, H., Luke, H., Cooke, P., Best, F., Scholz, N., Fear, D., Craig, N., Telfer, J., Wright, A., & Kruger, S. (2025). The application of digital tools for knowledge sharing in agriculture: A longitudinal case study from four Australian grower groups. Computers and Electronics in Agriculture, 230, 109843. https://doi.org/10.1016/j.compag.2024.109843

Rahmani, N., Vahabzadeh Menshi, S., & Mehrani, H. (2023). Designing a native digital marketing model for small online retail businesses in Iran. Entrepreneurship Development, 16(1), 109-120. https://doi.org/10.22059/jed.2022.343601.653967

Ranjbari, M., Shams Esfandabadi, Z., Siebers, P. O., Pisano, P., & Quatraro, F. (2024). Digitally enabled food sharing platforms towards effective waste management in a circular economy: A system dynamics simulation model. Technovation, 130, 102939. https://doi.org/10.1016/j.technovation.2023.102939

Rojanakit, P., Torres de Oliveira, R., & Dulleck, U. (2025). Beyond ownership: Exploring the sharing economy platforms in Thailand's emerging market. Journal of Business Venturing Insights, 24, e00556. https://doi.org/10.1016/j.jbvi.2025.e00556

Sharaf, R., Jaberi, A., & Lului, N. (2021). A critique of socialist theory of the sharing economy from an ethical perspective: Based on the thoughts of Friedrich Hayek and Ayn Rand. Critique and Opinion Scientific Research Quarterly (Philosophy and Theology), 26(3), 129-155. https://doi.org/10.22081/jpt.2021.60054.1815

Srisathan, W. A., & Naruetharadhol, P. (2025). The paradox of consumer level open innovation collaborators in sustainable consumption transformation. Sustainable Futures, 9, 100662. https://doi.org/10.1016/j.sftr.2025.100662

Tanveer, U., Agung Sahara, S. N., Kremantzis, M., & Ishaq, S. (2025). Integrating circular economy principles into a modified theory of Planned Behaviour: Exploring customer intentions and experiences with collaborative consumption on Airbnb. Socio-Economic Planning Sciences, 98, 102136. https://doi.org/10.1016/j.seps.2024.102136

Thomas, R. M., Nair, S., Benny, M. J., & Almeida, S. M. (2024). Comparative analysis of investment behaviour: exploring investment patterns and decision-making between generation x, generation y, and generation z. Management Journal for Advanced Research, 4(2), 21-35. https://doi.org/10.5281/zenodo.10937791

Torrent-Sellens, J. (2024). Digital transition, data-and-tasks crowd-based economy, and the shared social progress: Unveiling a new political economy from a European perspective. Technology in Society, 79, 102739. https://doi.org/10.1016/j.techsoc.2024.102739

Wang, Q., & Hu, J. (2025). How do artificial intelligence applications affect the labor income share? New challenges to common prosperity in the digital economy era. International Review of Economics and Finance, 103, 104536. https://doi.org/10.1016/j.iref.2025.104536

Weber, E. U., Blais, A. R., & Betz, N. E. (2002). A domain‐specific risk‐attitude scale: Measuring risk perceptions and risk behaviors. Journal of behavioral decision making, 15(4), 263-290. https://doi.org/10.1002/bdm.414

Wu, X., Wang, J., & Jiang, J. (2025). Insurance and the gig economy: Analyzing Chinese platform workers' participation in work-related injury insurance. Acta Psychologica, 256, 105016. https://doi.org/10.1016/j.actpsy.2025.105016