The Role of Family in Shaping Financial Literacy and Economic Behavior

Keywords:

Financial literacy, Economic behavior, Family influence, Financial socialization, Parental guidance, Financial education, Family dynamics, Economic well-beingAbstract

Objective: This study aims to explore the role of family in shaping financial literacy and economic behavior, examining how various family dynamics, structures, and financial socialization practices influence individuals' financial competencies and decision-making processes.

Methods: A qualitative research design was employed, utilizing semi-structured interviews to gather data from 20 participants. The interviews focused on participants' experiences with financial socialization within their families. Theoretical saturation was achieved, and NVivo software was used for thematic analysis to identify key themes and subthemes.

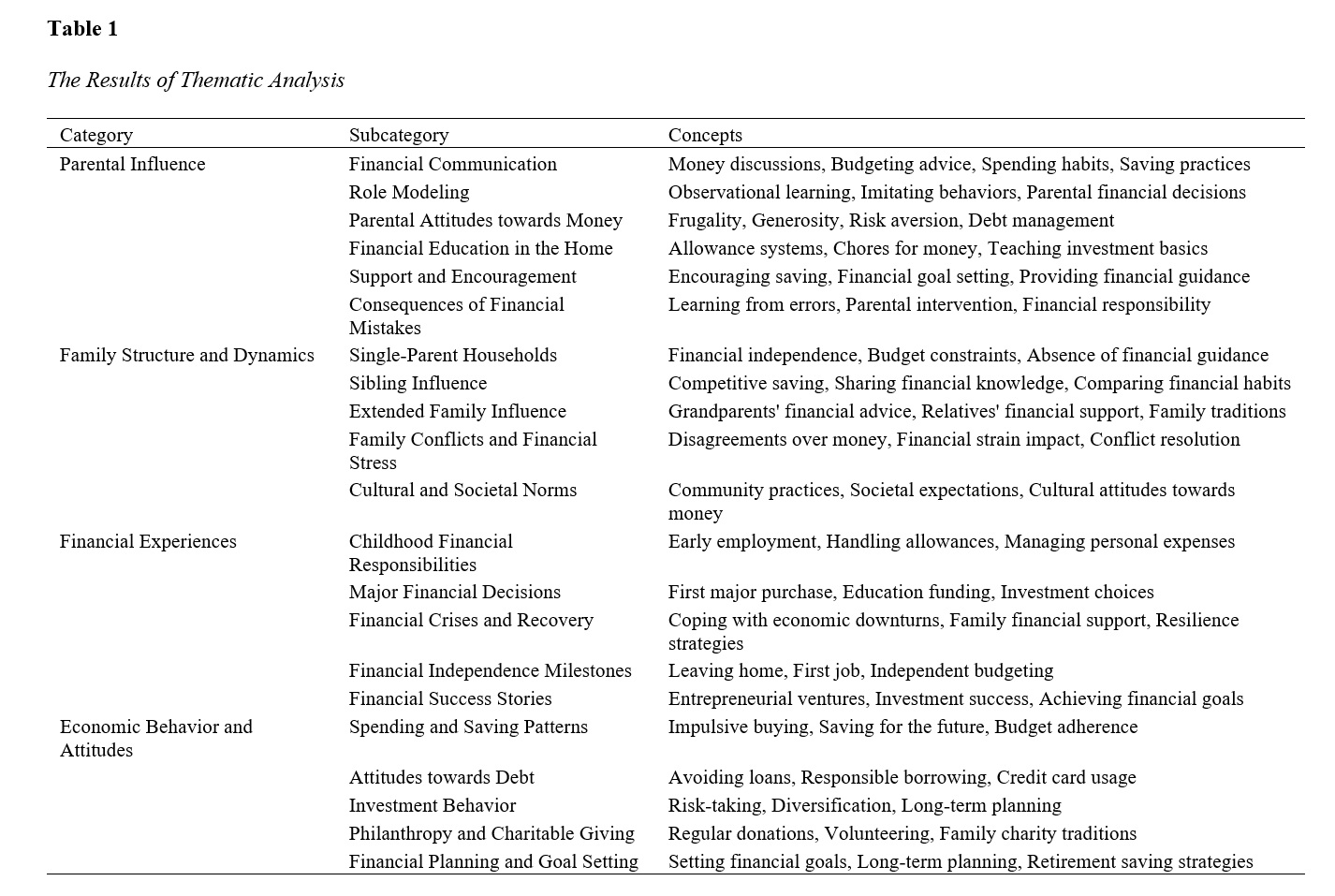

Results: The analysis revealed four main themes: parental influence, family structure and dynamics, financial experiences, and economic behavior and attitudes. Parental influence encompassed financial communication, role modeling, and financial education at home. Family structure and dynamics included single-parent households, sibling influence, and extended family involvement. Financial experiences covered early financial responsibilities and major financial decisions. Economic behavior and attitudes focused on spending and saving patterns, attitudes towards debt, and investment behavior. Participants emphasized the critical role of parental guidance and support in developing financial literacy.

Conclusion: The family plays a fundamental role in financial socialization, significantly impacting financial literacy and economic behavior. Parental influence, family structure, and financial experiences are pivotal in shaping financial competencies. Recognizing and supporting the family's role in financial education can enhance individuals' ability to navigate financial challenges and achieve economic well-being. Future research should explore these dynamics across diverse cultural contexts and longitudinally to deepen understanding and inform effective financial education strategies.

Downloads

Downloads

Additional Files

Published

Issue

Section

License

Copyright (c) 2024 Kobra Asadi (Author); Zahra Yousefi (Corresponding Author); Ali Mahdad (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.