Designing a Paradigmatic Model for Social Media Marketing in the Iranian Banking Services Industry

Keywords:

Native model, Marketing, Social media, Banking services industryAbstract

Objective: The current research aimed at designing a paradigmatic model for social media marketing in the Iranian banking services.

Methodology: This study employs an exploratory qualitative research method. The population of this research consisted of a group of experts, including professors in the field of marketing management and a group of banking industry experts in the marketing sector, who were deeply interviewed. In this study, sampling was conducted purposively until theoretical saturation was reached in the interviews, which continued until theoretical saturation was achieved with 16 experts interviewed. In this research, the main tool for data collection in the field section was semi-structured interviews, and the grounded theory approach was utilized using MAXQDA software version 2020 for analyzing collected data and presenting the paradigmatic model.

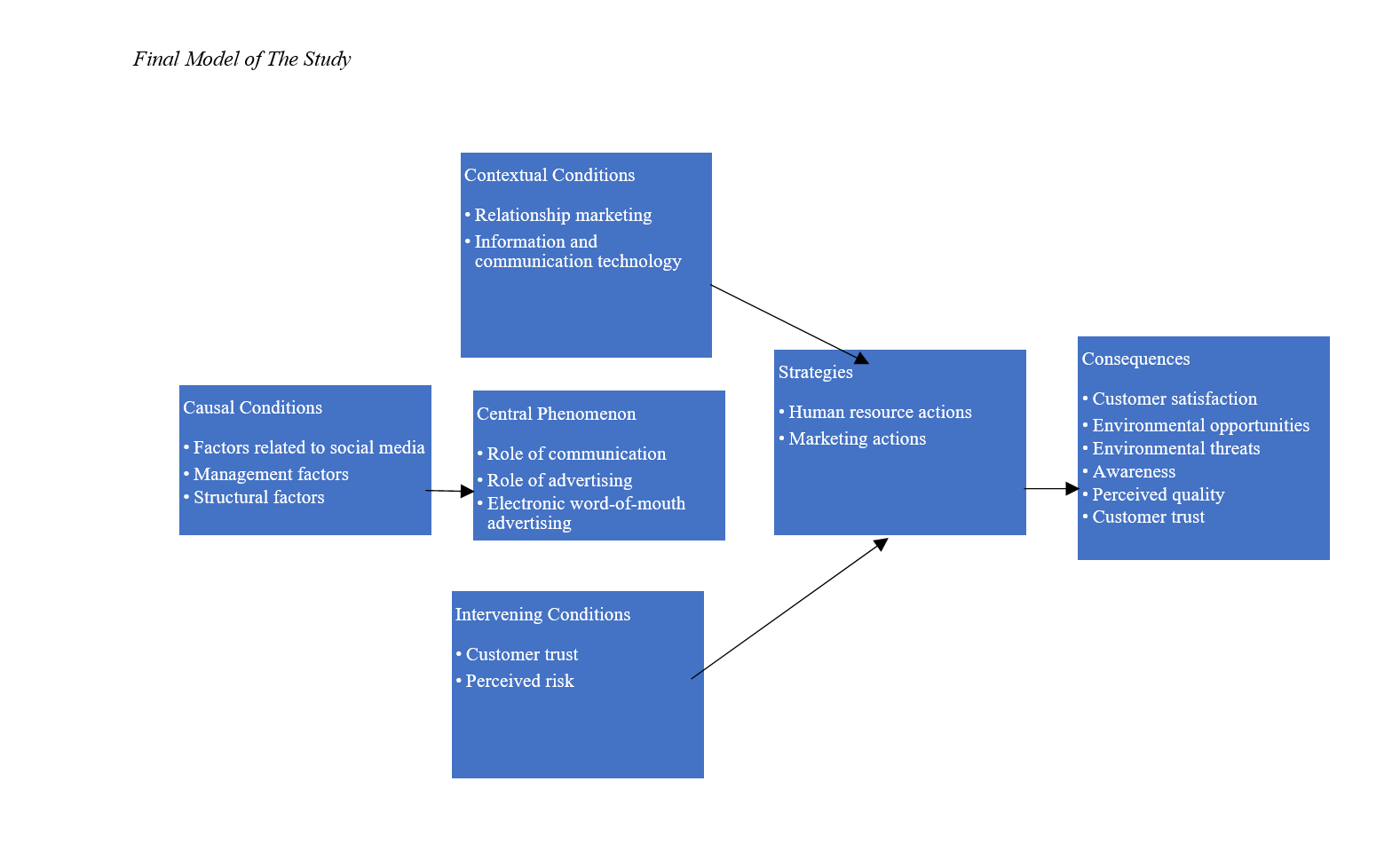

Findings: Consequently, after conducting open, axial, and selective coding, 18 categories and 70 indicators were identified within six main sections including causal conditions (factors related to social media, management factors, structural factors, electronic word-of-mouth advertising), contextual conditions (relationship marketing, information and communication technology), intervening conditions (customer trust, perceived risk), the core phenomenon of social media marketing (the role of communications, the role of advertising), strategies (human resources actions, marketing actions), and outcomes (customer satisfaction, environmental opportunities, environmental threats, awareness, perceived quality, customer trust). As a result, the paradigmatic model of a native social media marketing pattern in the Iranian banking services industry has been fully delineated with a qualitative approach considering six conditions (causal, contextual, intervening, the core phenomenon of social media marketing, strategies, and outcomes).

Conclusion: Banks can segment their target market and plan and act more for awareness raising for each segment of society as appropriate. The research and development department of banks should study hidden needs or sometimes define new needs for audiences and customers and introduce them in an attractive manner.

Downloads

Downloads

Additional Files

Published

Issue

Section

License

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.