Designing a Model of Professional Ethical Ideals Based on the Dimensions of Organizational Structure and Managers' Thinking Styles in Islamic Banking at the Agricultural Bank of Iran

Keywords:

Professional Ethics, Organizational Structure, Thinking Styles, Managers, BankingAbstract

Objective: The objective of this research is to design a model of professional ethical ideals based on the dimensions of organizational structure and managers' thinking styles in Islamic banking at the Agricultural Bank of Iran.

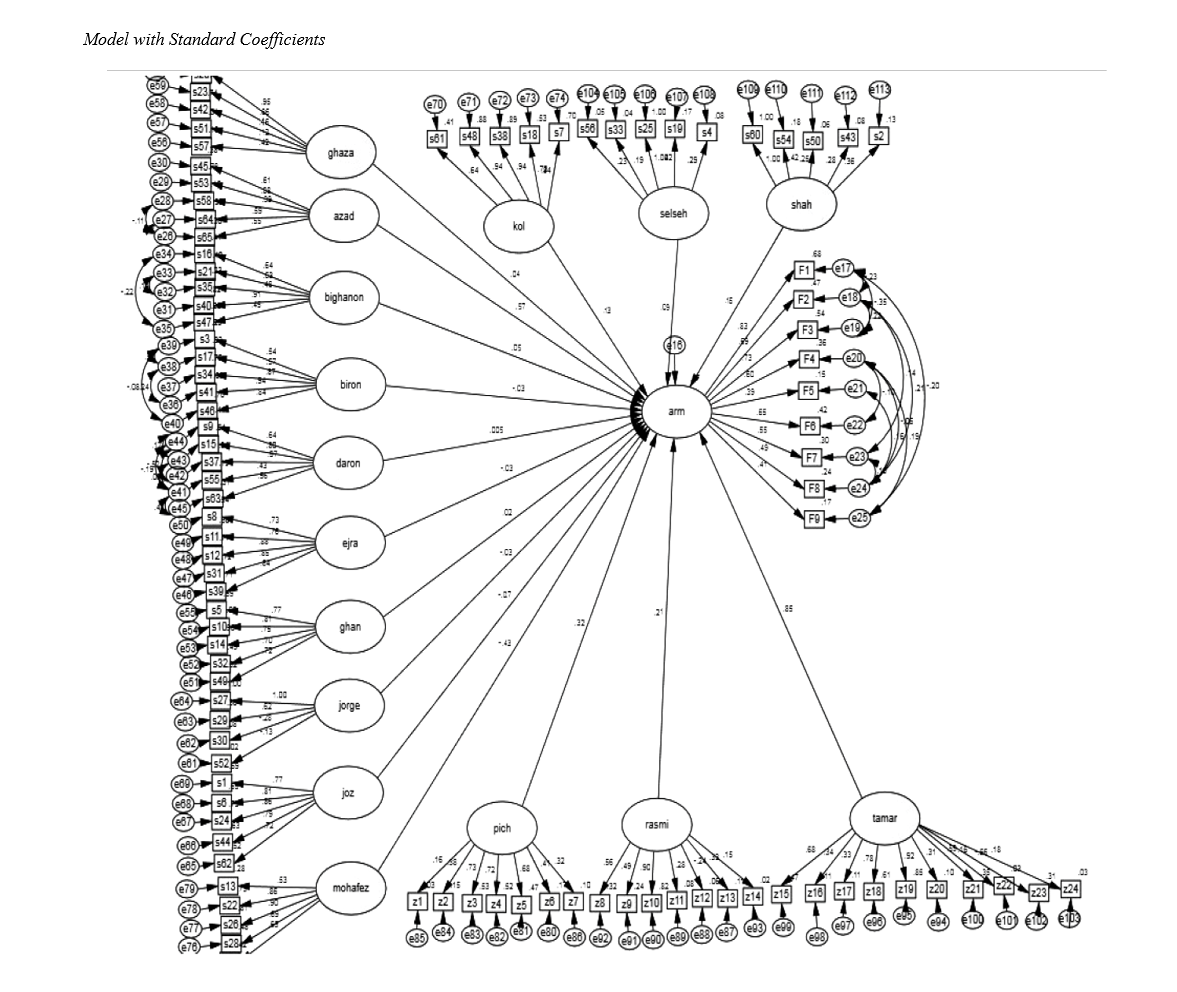

Methodology: This study is classified as applied research in terms of its purpose, and as a descriptive correlational study in terms of data collection methods. The statistical population includes two groups: the first group consists of 50 experts and professors in management and banking and ethics, who hold at least a doctoral degree and were selected through random sampling. The second group includes all senior managers, provincial managers, and top-ranking heads at the Agricultural Bank, totaling 430 individuals. Data analysis was conducted using SPSS23 and AMOS23 software, Pearson correlation coefficients, and structural equation modeling.

Findings: The results showed that the direct effect of the exogenous variable of legal thinking style (p < .05, t = 2.11, β = .12), holistic thinking style (p < .05, t = 2.64, β = .13), free-thinking style (p < .05, t = 7.34, β = .57), autocratic thinking style (p < .05, t = 2.532, β = .16), organizational complexity (p < .05, t = 2.65, β = .32), formality (p < .05, t = 5.84, β = .21), and organizational centralization (p < .05, t = 5.99, β = .85) on the variable of professional ethical ideals in Islamic banking is positive and significant. Additionally, the direct effect of the exogenous variable of conservative thinking style on the variable of professional ethical ideals in Islamic banking is negative and significant (p < .05, t = 6.26, β = -.43).

Conclusion: Support for and backing of producers and exporters, farmers, industrialists, and others should be a serious concern for banks. Therefore, it is recommended that Islamic banks fully comply with the policies of the Islamic government and the laws and regulations of the central bank, avoiding any form of sectionalism and profit-seeking outside these laws and regulations.

Downloads

Downloads

Additional Files

Published

Issue

Section

License

Copyright (c) 2024 Babak Kalantari (Author); Sanjar Salajeghe (Corresponding Author); Ayyub Sheykhi (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.