Do Human Capital Value Added Impact the Risk-Based Performance of Banks? (A Review Based on the CAMEL Model)

Keywords:

Human Capital Value-Added Coefficient, Banking, CAMEL, Nonlinear FunctionAbstract

Objective: The significance of human capital is well recognized in contemporary times, and the management of firms with a knowledge-centric approach has underscored the importance of intellectual and human capital as key competitive advantages. Among these, the banking industry holds considerable importance, necessitating the industry's focus on leveraging human capital.

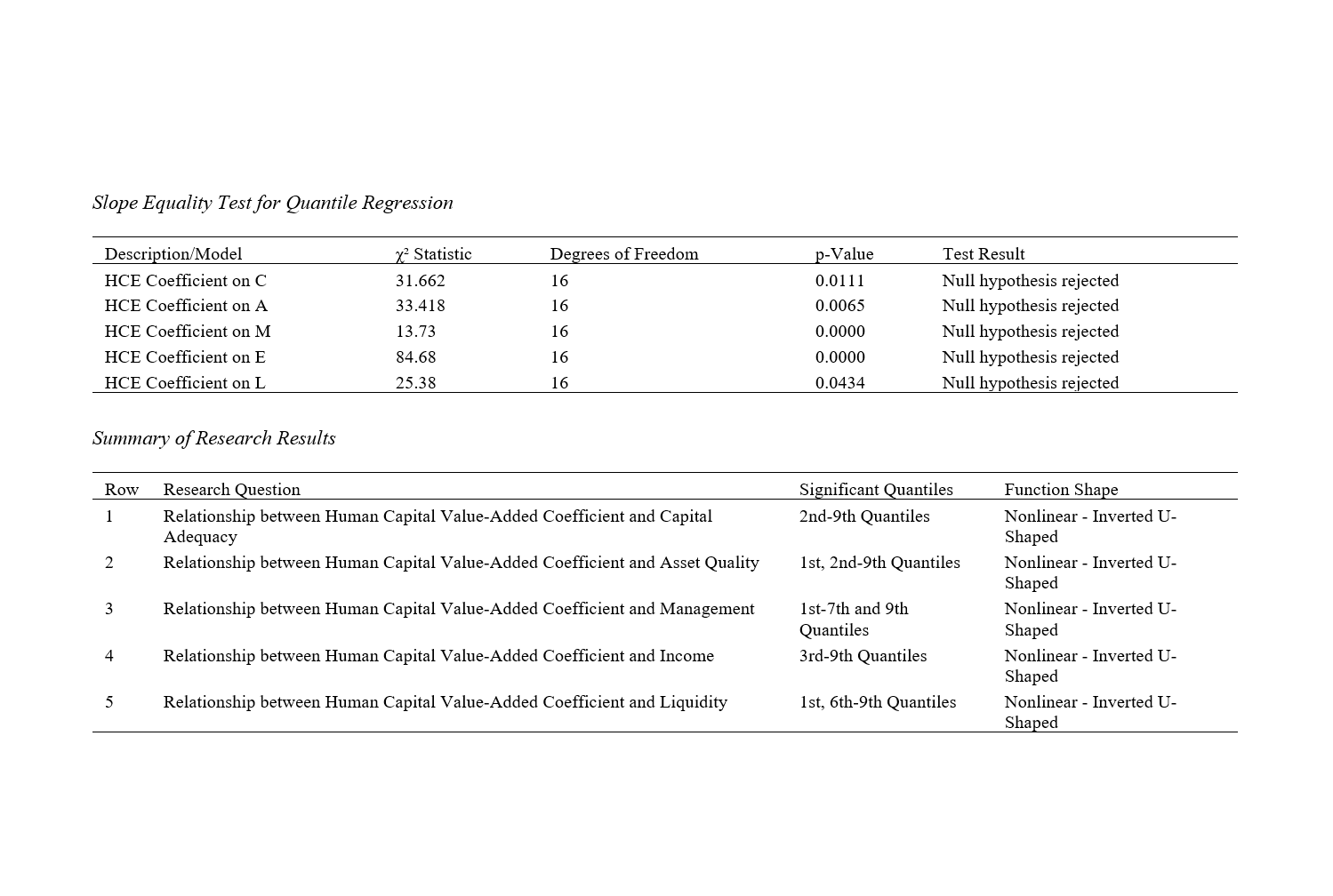

Methodology: This study examines the relationship between the human capital value-added coefficient, a component of intellectual capital, and bank performance. The CAMEL model is employed to determine the functional components of bank performance. Financial statement data from 12 banks for the years 2012 to 2022 were utilized.

Findings: The study's findings indicate a significant relationship between the intellectual capital value-added coefficient and variables such as capital adequacy, asset quality, management, and income, with a nonlinear inverted U-shaped function. In contrast, the relationship between the human capital value-added coefficient and liquidity is nonlinear and U-shaped.

Conclusion: The study reveals that human capital value-added significantly impacts bank performance indicators, exhibiting nonlinear, inverted U-shaped relationships with capital adequacy, management, and income, and a U-shaped relationship with liquidity. Strategic investment in human capital is essential for optimizing these performance metrics in the banking sector.

Downloads

Downloads

Additional Files

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2024 Mohammad Pourgholamali (Author); Mohsen Hamidian (Corresponding Author); Roya Darabi (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.