Examining the Impact of Company Size, Ownership Structure, Liquidity, and Industry Type on Continuous Innovation Capability in Companies Listed on the Tehran Stock Exchange

Keywords:

Sustainable Innovation, Company Size, Ownership Structure, Stock ExchangeAbstract

Objective: Studying the factors influencing companies' innovation capability is of great importance. Therefore, the main objective of this research was to examine the effects of company size, ownership structure, liquidity, and industry type on the continuous innovation capability of companies listed on the Tehran Stock Exchange.

Methodology: Given the structure of the data studied in this research, which included the time dimension (2011 to 2022), the panel data method was used. The statistical population of this study is the Tehran Stock Exchange and all companies listed on it. A purposive sampling method was used in this research. Using this method, the research sample included manufacturing companies listed on the Tehran Stock Exchange during the period from 2011 to 2022. Additionally, EViews software version 12 was used to analyze the data.

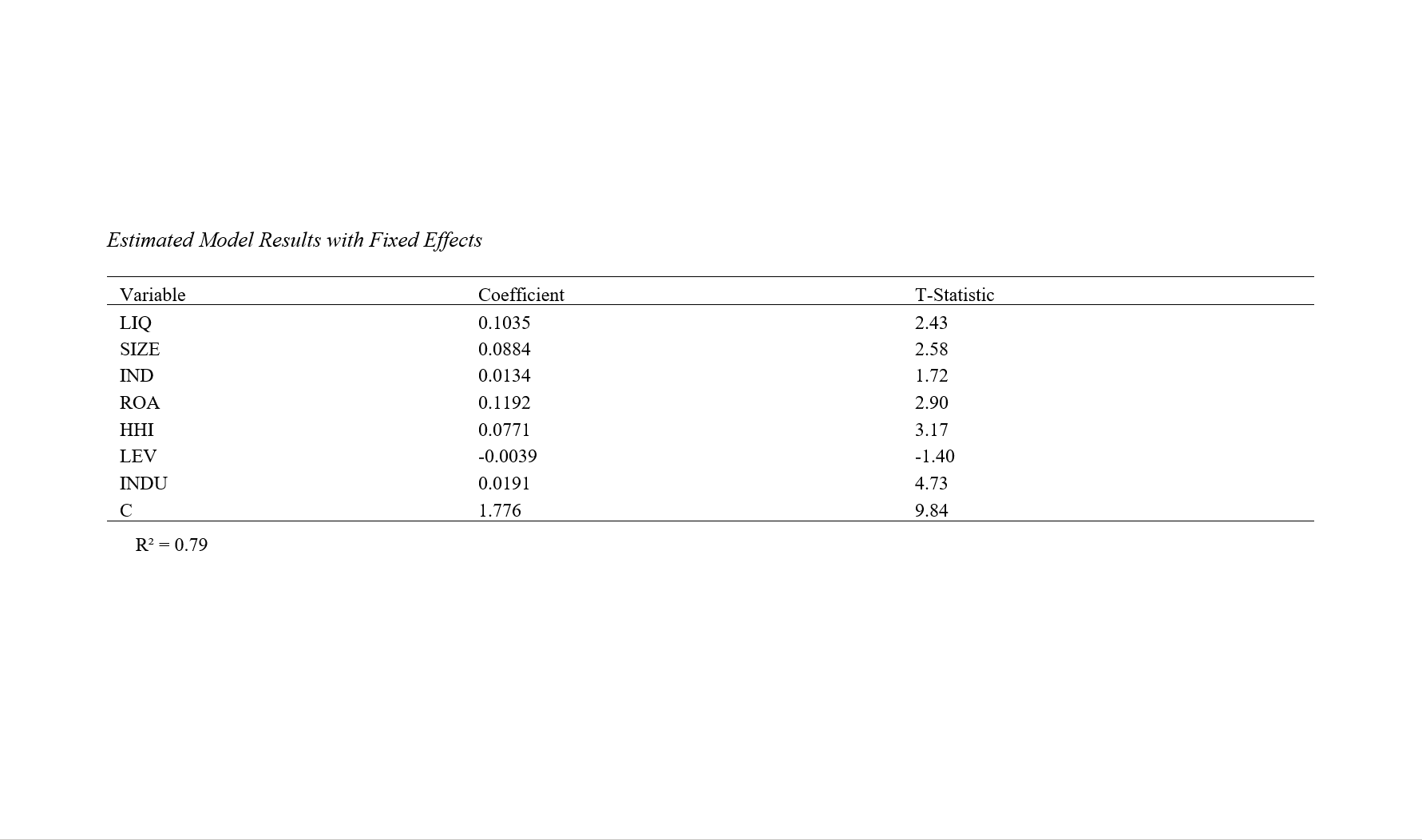

Findings: The findings showed that the coefficient of the variable company size on companies' innovation capability was 0.088 and the estimated T-statistic was 2.58. Therefore, it can be stated that company size has a positive and significant effect on companies' sustainable innovation capability. Additionally, the coefficient of the variable ownership structure on companies' innovation capability was 0.077 and the estimated T-statistic was 3.17, which indicates that ownership structure has a positive and significant effect on companies' sustainable innovation capability. The variable stock liquidity on companies' innovation capability had a coefficient of 0.1035 and an estimated T-statistic of 2.43. Finally, the coefficient of the variable industry type on companies' innovation capability was 0.1035 and the estimated T-statistic was 2.43. Therefore, it can be stated that industry type has a positive and significant effect on companies' sustainable innovation capability.

Conclusion: It can be concluded that the larger the companies and the more transparent the ownership structure, the higher the companies' innovation capability.

Downloads

Downloads

Additional Files

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2024 Mahdieh Rajabi Sarkhoni (Author); Morteza Bavaghar (Corresponding Author); Mohammad Hossein Ranjbar, Saeed Moradpour (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.