Examining the Impact of Behavioral-Psychological Components of Investors’ Model for Decision-Making Based on Environmental Drivers in the Tehran Stock Exchange

Keywords:

Behavioral-psychological model, investor decision-making, environmental drivers, Tehran Stock Exchange, structural equation modelingAbstract

Objective: This study aims to develop and validate a behavioral-psychological model of investors' decision-making influenced by environmental drivers in the Tehran Stock Exchange.

Methodology: The study employed a grounded theory approach using Strauss and Corbin's methodology, with data collected from semi-structured interviews conducted in 2021 and 2022. The participants comprised 384 investment managers and experts from the Tehran Stock Exchange, selected through random-cluster sampling based on Morgan’s table. Data were collected using a 5-point Likert scale questionnaire to assess perceptions and behavior patterns and were analyzed through structural equation modeling (SEM) using SmartPLS software.

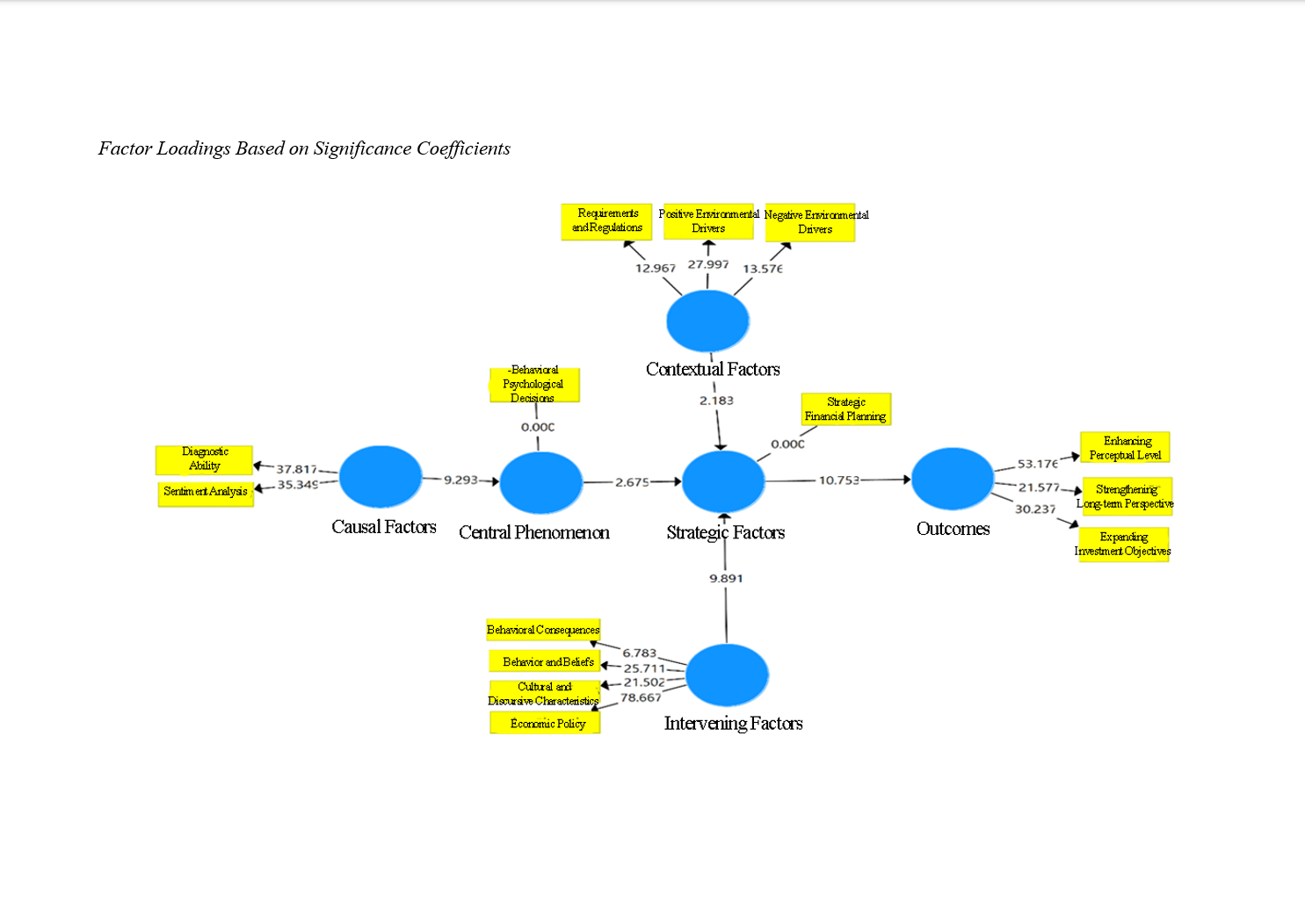

Findings: The results revealed that investors’ decisions are shaped by several dimensions, including causal factors (such as diagnostic ability and sentiment analysis), contextual factors (including positive and negative environmental drivers and regulatory requirements), intervening factors (such as behavioral outcomes, cultural characteristics, investor beliefs, and government economic policy), and strategic factors (like strategic financial planning). These dimensions collectively impact the central phenomenon of behavioral-psychological decision-making. The model’s outcomes were also validated, showing enhancements in investors’ perceptual levels, strengthened long-term perspectives, and expanded investment goals. The model's reliability and validity were confirmed using Cronbach's alpha, composite reliability, and AVE measures, with all indicators falling within acceptable ranges.

Conclusion: Recognizing these drivers and investor biases allows for a more comprehensive understanding of market dynamics, suggesting that investment firms and policymakers should consider these behavioral patterns in strategic planning.

Downloads

References

Abbasi Mosleu, K. S., & Tehrani, N. (2019). Investigating the relationship between disruptive trading and stock returns in the Iranian stock market. Financial Management Outlook, 9(25), 77-99. http://ensani.ir/fa/article/journal-number/45454/%D8%B4%D9%85-%D8%A7%D9%86%D8%AF%D8%A7%D8%B2-%D9%85%D8%AF%DB%8C%D8%B1%DB%8C%D8%AA-%D9%85%D8%A7%D9%84%DB%8C-%D8%B3%D8%A7%D9%84-%D9%86%D9%87%D9%85-%D8%A8%D9%87%D8%A7%D8%B1-1398-%D8%B4%D9%85%D8%A7%D8%B1%D9%87-25-

Abdolrahimian, M. H., Torabi, T., Sadeghi Sharif, S. J., & Darabi, R. (2018). Providing a behavioral model for individual investor decision-making in Tehran Stock Exchange. Investment Knowledge, 7(26), 113-130. https://jik.srbiau.ac.ir/article_12604.html

Alabass, H. S. H. H. (2019). The Impact of Corporate Investment Behaviour On the Corporate Performance. https://www.abacademies.org/articles/the-impact-of-corporate-investment-behaviour-onthe-corporate-performance-evidence-from-an-emerging-market-7800.html

Aref Manesh, Z., Rameshe, M., & Shokoohi, H. (2022). The relationship between enterprise risk management and company performance with the role of competitive advantage and financial literacy. Research in Financial Accounting and Auditing, 14(54), 79-100. http://ensani.ir/fa/article/511534/%D8%B1%D8%A7%D8%A8%D8%B7%D9%87-%D8%A8%DB%8C%D9%86-%D9%85%D8%AF%DB%8C%D8%B1%DB%8C%D8%AA-%D8%B1%DB%8C%D8%B3%DA%A9-%D8%B3%D8%A7%D8%B2%D9%85%D8%A7%D9%86%DB%8C-%D9%88-%D8%B9%D9%85%D9%84%DA%A9%D8%B1%D8%AF-%D8%B4%D8%B1%DA%A9%D8%AA-%D8%A8%D8%A7-%D9%86%D9%82%D8%B4-%D9%85%D8%B2%DB%8C%D8%AA-%D8%B1%D9%82%D8%A7%D8%A8%D8%AA%DB%8C-%D9%88-%D8%B3%D9%88%D8%A7%D8%AF-%D9%85%D8%A7%D9%84%DB%8C

Asiabi, L., Rahimzadeh, A., Felihi, N., & Rajai, Y. (2021). Portfolio selection based on behavioral economics methods (case study of Tehran Stock Exchange). Financial Economics, 15(55), 155-190. https://www.researchgate.net/publication/266200735_A_hybrid_fuzzy_decision_making_method_for_a_portfolio_selection_A_case_study_of_Tehran_Stock_Exchange

Bakar, S., & Chui Yi, A. (2016). The Impact of Psychological Factors on Investors' Decision Making in Malaysian Stock Market: A Case of Klang Valley and Pahang. Procedia Economics and Finance, 35, 319-332. https://doi.org/10.1016/S2212-5671(16)00040-X

Barabari, M. R., & Akbari. (2019). Investigating influential variables in behavioral finance University of Tehran]. https://acctgrev.ut.ac.ir/author.index?vol=0

Barzegari Khanqah, J., Hejazi, R., & Reza Zadeh, F. (2017). The impact of media coverage on investor decision-making in the stock market. Research in Financial Accounting and Auditing, 9(33), 107-124. https://journals.iau.ir/article_531511.html

Bashiri Manesh, N., & Shahnazi, H. (2022). The impact of investor and managerial behavioral biases on stock price bubbles in Iran's capital market. Financial Knowledge Securities Analysis, 15(53), 15-32. https://www.sid.ir/paper/1063333/fa

Chavoshi, S. K., & Foulatoon Nejad, F. (2017). Presenting an analytical model of investor decision-making behavior in Tehran Stock Exchange. Investment Knowledge, 6(23), 105-128. https://translate.google.com/translate?hl=en&sl=fa&u=https://jik.srbiau.ac.ir/article_10997.html&prev=search&pto=aue

Dadar, O., & Jafari, S. M. (2020). Examining the impact of emotional investor behavior and free-floating shares on stock returns in Tehran Stock Exchange using Generalized Method of Moments (GMM). Investment Knowledge, 9(34), 317-331. https://www.sid.ir/paper/386332/fa

Daneshi, Y., & Esmailzadeh, A. (2022). The impact of enterprise risk management system quality and audit committee characteristics on company reputation. Research in Financial Accounting and Auditing, 14(54), 207-232. https://faar.ctb.iau.ir/article_693675.html

Ebrahimi Lifshagar, A., Pakizeh, K., & Reisi Far, K. (2019). The effect of investor personality on their investment performance with the mediating role of heuristic biases. Financial Knowledge Securities Analysis, 12(42), 107-128. https://www.sid.ir/paper/200051/fa

Farhadi Sharif Abad, M., & Doaei, M. (2012). Modeling investor tendencies with an emphasis on psychological factors using fuzzy Delphi and DEMATEL methods. Advances in Finance and Investment, 2(5), 113-144. https://afi.journals.iau.ir/article_690369.html

Jabari Khoozani, A., Salehi, E. K., Kaab Omeir, A., & Zarin Jooei Alvar, S. (2022). Designing a behavioral bias model for investors using theme analysis and fuzzy Delphi-structural interpretive approach. Advances in Finance and Investment, 3(9), 73-106. https://srb.sanad.iau.ir/en/Article/1088267

Jering, L., Martinez, N. C. A., & da Costa, N. C. (2016). Earnings Manipulations by Real Activities Management and Investors' Perceptions. Research in International Business and Finance, 34, 309-323. https://doi.org/10.1016/j.ribaf.2015.02.015

Mahboobi, H., Damankeshideh, M., Momeni Vasalian, H., & Nasabian, S. (2023). The effect of macroeconomic indicators on stock return volatility. Research in Financial Accounting and Auditing, 15(59), 199-218. http://ensani.ir/fa/article/558622/%D8%AA%D8%A3%D8%AB%DB%8C%D8%B1-%D8%B4%D8%A7%D8%AE%D8%B5-%D9%87%D8%A7%DB%8C-%DA%A9%D9%84%D8%A7%D9%86-%D8%A7%D9%82%D8%AA%D8%B5%D8%A7%D8%AF%DB%8C-%D8%A8%D8%B1-%D9%86%D9%88%D8%B3%D8%A7%D9%86%D8%A7%D8%AA-%D8%A8%D8%A7%D8%B2%D8%AF%D9%87-%D8%B3%D9%87%D8%A7%D9%85

Mirbozorgi, S. P., Hemmat Far, M., & Jenani, M. H. (2022). Explaining an appropriate model of investor risk-taking power based on personality traits. Research in Financial Accounting and Auditing, 14(53), 135-162. https://www.sid.ir/paper/958409/%D8%AE%D8%B1%DB%8C%D8%AF%20%D8%A7%D9%82%D8%B3%D8%A7%D8%B7%DB%8C%20%DA%AF%D9%88%D8%B4%DB%8C%20%D8%A2%DB%8C%D9%81%D9%88%D9%86%2014

Mirlohi, S. M., & Mohammadi Tudeshki, N. (2020). Forming an optimal investment portfolio in Tehran Stock Exchange using hierarchical and divisive clustering methods. Investment Knowledge, 9(34), 333-335. https://jik.srbiau.ac.ir/article_16212.html

Momeni, A., & Rezaei Ghal'e, Z. (2018). The impact of economic factors on emotional investor tendencies in Tehran Stock Exchange. Fifth National Conference on Applied Research in Management and Accounting,

Petit, J. J. G., Lafuente, E. V., & Vieites, A. R. (2019). How information technologies shape investor sentiment: A web-based investor sentiment index. Borsa Istanbul Review, 19(2), 95-105. https://doi.org/10.1016/j.bir.2019.01.001

Raki, M., Mehrara, M., Abbasi Nejad, H., & Soori, A. (2020). Modeling the effect of loss aversion bias on return rate and stock price dynamics (agent-based modeling in behavioral finance). Financial Knowledge Securities Analysis, 13(45), 165-180. https://www.sid.ir/fileserver/jf/6004613994510.pdf

Ronen, T., & Lewinstein Yaari, V. (2021). On the tension between full revelation and earnings management: A reconsideration of the revelation principle. Journal of Accounting, Auditing and Finance, 17(4), 273-294. https://doi.org/10.1177/0148558X0201700401

Saadatzadeh Hisar, B., Abdi, R., Mohammad Zadeh Salteh, H., & Narimani, M. (2021). Investigating the relationship between cognitive biases in investor behavior and stock price volatility. Financial Economics, 15(56), 303-320. https://journals.iau.ir/article_687880.html

Seydian Monir, S., Zanjir Dar, M., & Rafiei, N. (2019). The effect of investor tendencies and arbitrage limitations on portfolio returns at various levels of excess cash. New Research Approaches in Management and Accounting, 3(9), 263-282. http://ensani.ir/fa/article/401688/%D8%AA%D8%A3%D8%AB%DB%8C%D8%B1-%D8%AA%D9%85%D8%A7%DB%8C%D9%84%D8%A7%D8%AA-%D8%B3%D8%B1%D9%85%D8%A7%DB%8C%D9%87-%DA%AF%D8%B0%D8%A7%D8%B1-%D9%88-%D9%85%D8%AD%D8%AF%D9%88%D8%AF%DB%8C%D8%AA-%D8%A2%D8%B1%D8%A8%DB%8C%D8%AA%D8%B1%D8%A7%DA%98-%D8%A8%D8%B1-%D8%A8%D8%A7%D8%B2%D8%AF%D9%87-%D9%BE%D8%B1%D8%AA%D9%81%D9%88%DB%8C-%D8%AF%D8%B1-%D8%B3%D8%B7%D9%88%D8%AD-%D9%85%D8%AE%D8%AA%D9%84%D9%81-%D9%88%D8%AC%D9%87-%D9%86%D9%82%D8%AF-%D9%85%D8%A7%D8%B2%D8%A7%D8%AF

Zanjir Dar, M., Mousavi, R., & Saberi, M. (2013). Explaining human behavioral factors in optimal portfolio selection in comparison with standard finance. Investment Knowledge, 3(9), 207-222. https://www.sid.ir/fa/journal/ViewPaper.aspx?id=213004

Downloads

Additional Files

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2024 Mohammad Hosein Shiehmorteza (Author); Payman Ghafari Ashtiani (Corresponding Author); Majid Davooudinasr (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.