Examining the Impact of Behavioral Bias of Mental Accounting by Investors on Financial Policies of Companies Listed on the Tehran Stock Exchange

Keywords:

accounting bias, mental accounting, financial policies, panel data modelAbstract

Objective: This study investigates the impact of the behavioral bias of mental accounting by investors on the financial policies of companies listed on the Tehran Stock Exchange.

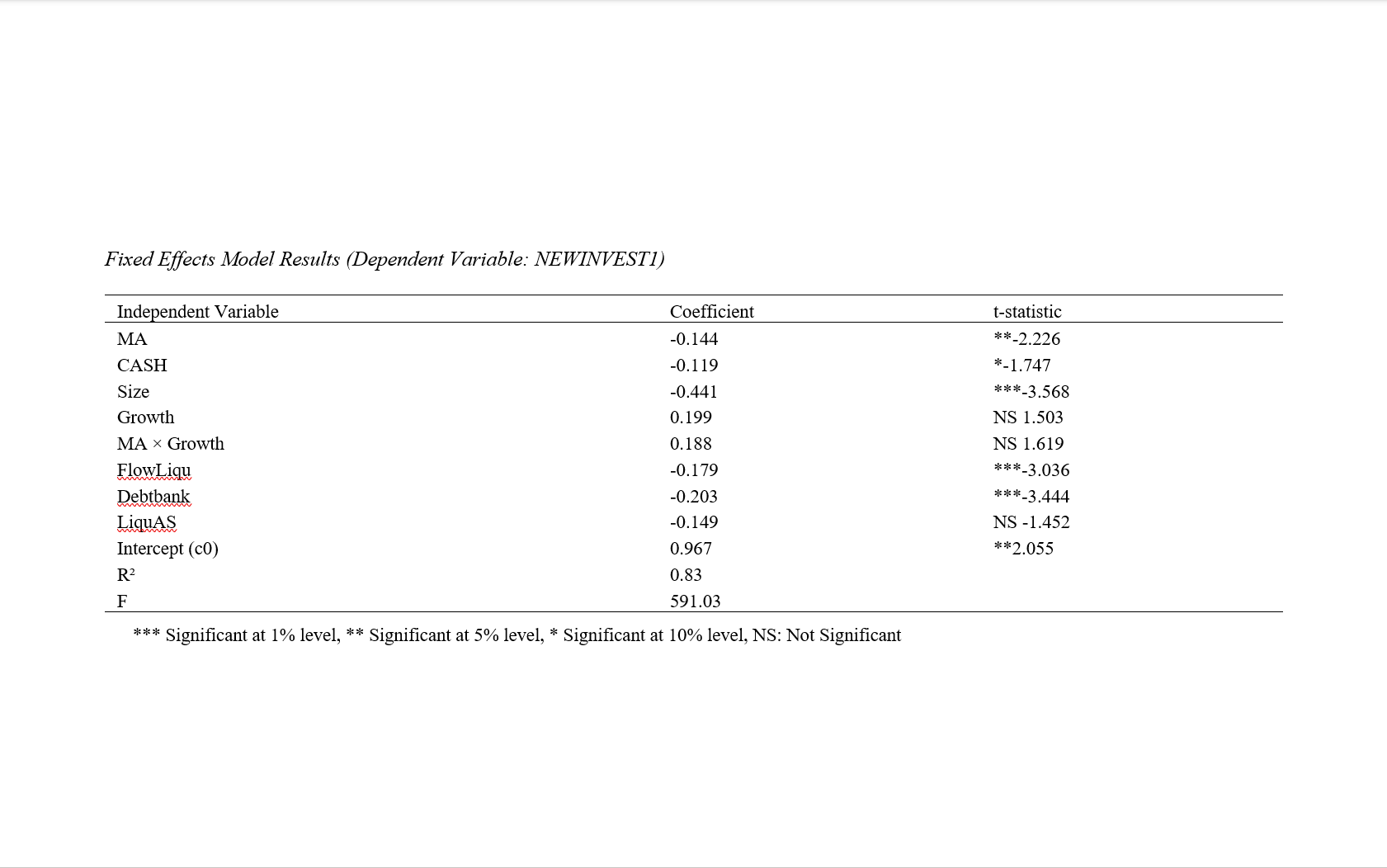

Methodology: The statistical population of the study comprises 14 leading investment companies and their investee companies, totaling 109 companies, during the period 2014–2020. Financial leverage, dividend payouts, and the debt ratio were used as indicators of financial policy. Data analysis was conducted using panel data models and STATA software.

Findings: The results indicated that the analyzed investment companies exhibited the behavioral bias of mental accounting in 35.71% of cases. Furthermore, mental accounting by investors had a significant inverse impact on financial leverage, a negative impact on homogeneous cash dividends, and a significant direct impact on the debt ratio as financial policy indicators of the companies.

Conclusion: The study confirms that mental accounting influences financial policies by altering financing behaviors, especially regarding debt maturity and long-term debt-to-equity ratio. However, its effect on the relationship between growth opportunities and tangible fixed asset growth is negligible. These findings align indirectly with theoretical and empirical literature, such as prospect theory and disposition effect studies, indicating a broader behavioral bias in investment and financing decisions. The study highlights the need for further research to explore mental accounting's broader implications in financial and investment policy-making.

Downloads

References

Agbaji, A. L. (2021). Leadership and Managerial Decision-Making in an AI-Enabled Oil and Gas Industry. Abu Dhabi International Petroleum Exhibition & Conference,

Alwaely, S. A., Aboutaleb, A. H., Alqudah, H., Musleh, O. A., Abusalma, A., Halim, M., & Darawsheh, S. R. (2024). Empowering Educational Leadership: Examining Self-Management of School Leaders and its Impact on Teachers' Participation in Decision-Making within the United Arab Emirates (UAE). Kurdish Studies, 12(2), 2559-2570. https://kurdishstudies.net/menu-script/index.php/KS/article/view/2292

Amin, V., Salehnezhad, S. H., Rezaei Pitenoei, Y., & Lotfi, M. (2023). Investigating the impact of intellectual capital on competitive performance in Iran's banking system. Governmental Accounting, 9(2), 109-128. https://doi.org/10.30473/gaa.2022.59033.1483

Banabi Ghadim, R., & Karbasi Yazdi, H. (2014). Application of mental accounting theory. Accounting Research, 13, 1-17. https://jaacsi.alzahra.ac.ir/article_499.html

Emami, D., Ahmadi, M., & Ghaffari, R. (2024). Presenting a Pattern of Flexible working Hours in Government Organizations with an Emphasis on Increasing the Productivity Level of Academic Employees in the Ministry of Cooperation, Labor and Social Welfare [Research Article]. Iranian Journal of Educational Sociology, 7(1), 57-65. https://doi.org/10.61838/kman.ijes.7.1.6

Ghaffarian, S., Memarzadeh Tehrani, G., Mohammadi, N., & Farahmandian, A. (2024). Presenting a Model for Developing Employee Commitment in Iranian Government Organizations. International Journal of Innovation Management and Organizational Behavior (IJIMOB), 4(3), 55-67. https://doi.org/10.61838/kman.ijimob.4.3.7

Grinblatt, M., & Han, B. (2005). Prospect theory, mental accounting, and momentum. Journal of Financial Economics, 78, 311-339. https://doi.org/10.1016/j.jfineco.2004.10.006

Han, F. (2024). The Impact of the Book Publishing Transmedia Storytelling Model On business Performance: The moderating Role of the Innovation Environment. Journal of Organizational Change Management, 37(8), 1-17. https://doi.org/10.1108/jocm-07-2023-0289

Khong, I., Aprila Yusuf, N., Nuriman, A., & Bayu Yadila, A. (2023). Exploring the Impact of Data Quality on Decision-Making Processes in Information Intensive Organizations. APTISI Transactions on Management, 7(3), 253-260. https://doi.org/10.33050/atm.v7i3.2138

Nisar, Q. A., Nasir, N., Jamshed, S., Naz, S., Ali, M., & Ali, S. (2021). Big data management and environmental performance: role of big data decision-making capabilities and decision-making quality. Journal of Enterprise Information Management, 34(4), 1061-1096. https://doi.org/10.1108/JEIM-04-2020-0137

Rengkung, L. R. (2022). EXPLORATION AND EXPLOITATION: DRIVING ORGANIZATIONAL CAPABILITY AND ORGANIZATIONAL CHANGE TOWARD COMPETI-TIVE ADVANTAGE. Management Theory and Studies for Rural Business and Infrastructure Development, 44(1), 39-51. https://doi.org/10.15544/mts.2022.05

Seifi, E., Ahmadi, A., & Moazzami, M. (2024). Identifying the dimensions and components of the application of new technologies in the fourth generation university. Management and Educational Perspective, 5(4), 24-51. https://doi.org/10.22034/jmep.2024.426783.1282

Shams, S., & Esfandiyari Moghadam, A. T. (2017). The impact of herding behavior on the performance of investment companies. Financial Research, 19(1), 97-118. https://jfr.ut.ac.ir/article_64230.html?lang=en

Shepherd, D. A., Williams, T. A., & Patzelt, H. (2014). Thinking About Entrepreneurial Decision Making: Review and Research Agenda. Journal of Management, 41(1), 11-46. https://doi.org/10.1177/0149206314541153

Trihadi Pudiawan, E., Sebastiaan, v. D., Arnold, J., & Irwan Adi, E. (2023). Digital marketing innovation and firm performance: the role of decision-making comprehensiveness in dynamic environments. Asia Pacific Journal of Marketing and Logistics, ahead-of-print(ahead-of-print). https://doi.org/10.1108/APJML-01-2023-0097

Downloads

Additional Files

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Mohamad Sadegh Shahsavari (Author); Mohammad Hossein Ranjbar (Corresponding Author); Hojjatallah Salari , Ali Amiri (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.