Explaining and Prioritizing Factors Influencing Retirement Incentives Using a Multi-Criteria Decision-Making Approach

Keywords:

Retirement Costs, Aging Period, Retirement Incentives, Social SecurityAbstract

Objective: The purpose of the present study is to explain and prioritize factors influencing retirement incentives using a multi-criteria decision-making approach.

Methodology: This research is applied in its aim and relies on a survey design with a descriptive-inductive reasoning approach. Regarding the nature of data and analysis methods, the study is quantitative. For the expert population, the study employed multi-criteria descriptive reasoning with an analytical network process (ANP) using snowball sampling, selecting 21 experts. Furthermore, through multi-criteria decision-making methods, factors influencing social security retirement incentives were identified and subsequently prioritized using fuzzy DEMATEL analysis. The complementary statistical population comprises workers employed in over 600 industrial companies, several service organizations, self-employed individuals subject to social security laws, and government companies, totaling more than 8,200 individuals. Given the extensive population, a minimum of 384 participants was required based on Cochran’s formula. In this study, 540 individuals were randomly selected using a computer-simulated method based on social security codes, focusing on their last five years prior to retirement.

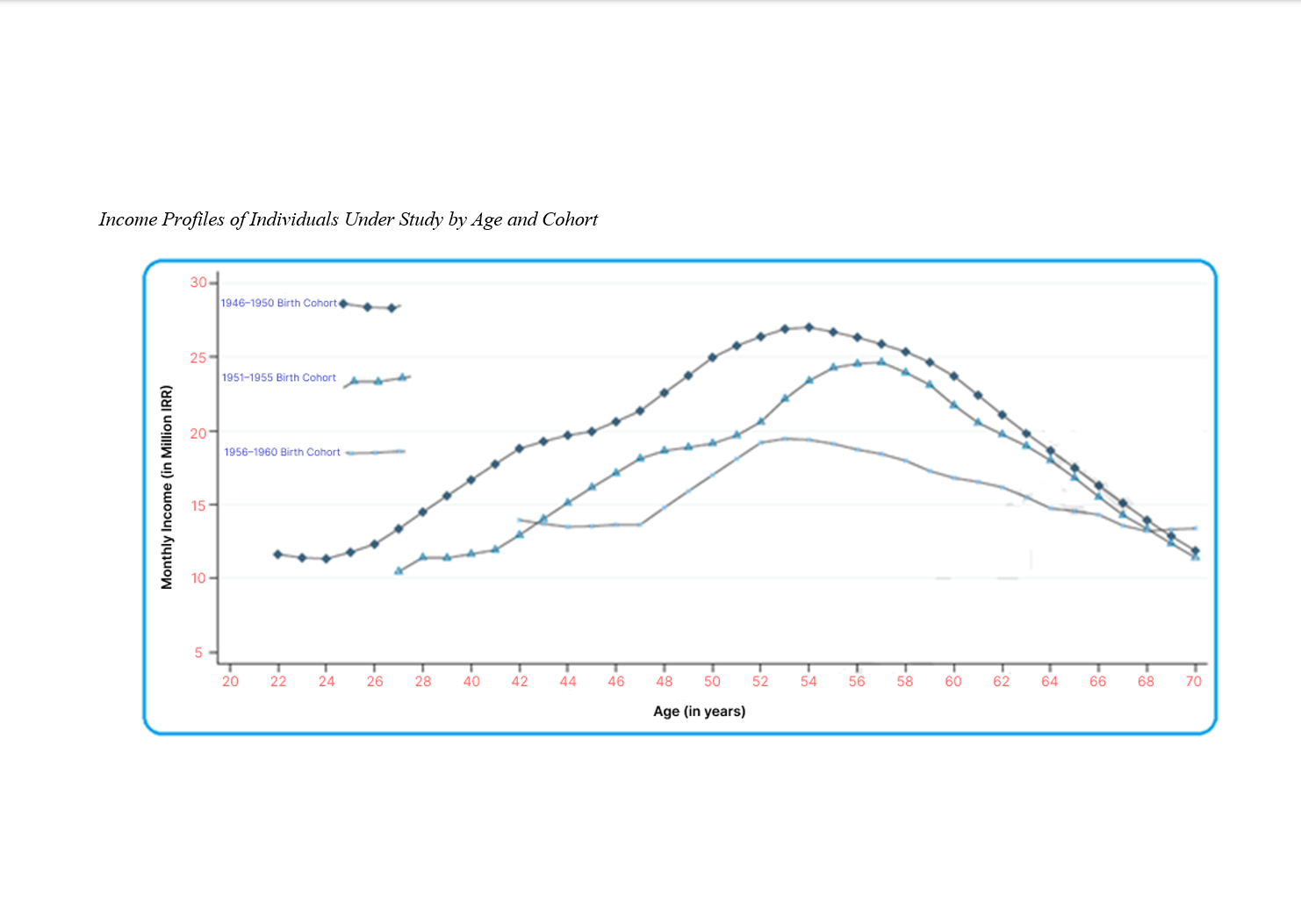

Findings: According to the study’s findings, retirement incentives include: accrued value, peak payments, and optional value, estimated based on each individual’s social security pension and income profile. The dynamic interaction between wage income and retirement benefits may provide more accurate estimates of retirement incentives. The study hypothesizes that due to relatively low levels of social security pensions, workers in the study region are more likely to respond to changes in monthly wage income rather than retirement benefits.

Conclusion: The research findings indicate that for all three criteria, the estimates decrease with age. This trend suggests that retirement costs increase until a specific age and then begin to decline.

Downloads

Downloads

Additional Files

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2024 Jafar Abrishambaf (Author); Hassan Ghodrati Ghazaani (Corresponding Author); Hossein Panahian, Meysam Arabzadeh , Hossein Jabari (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.