Presentation of a Digital Transformation Model for Customer Experience in Insurance Products (Case Study: Asmari Insurance)

Abstract

Objective: The aim of this research is to present a digital transformation model for customer experience in insurance products in the insurance industry.

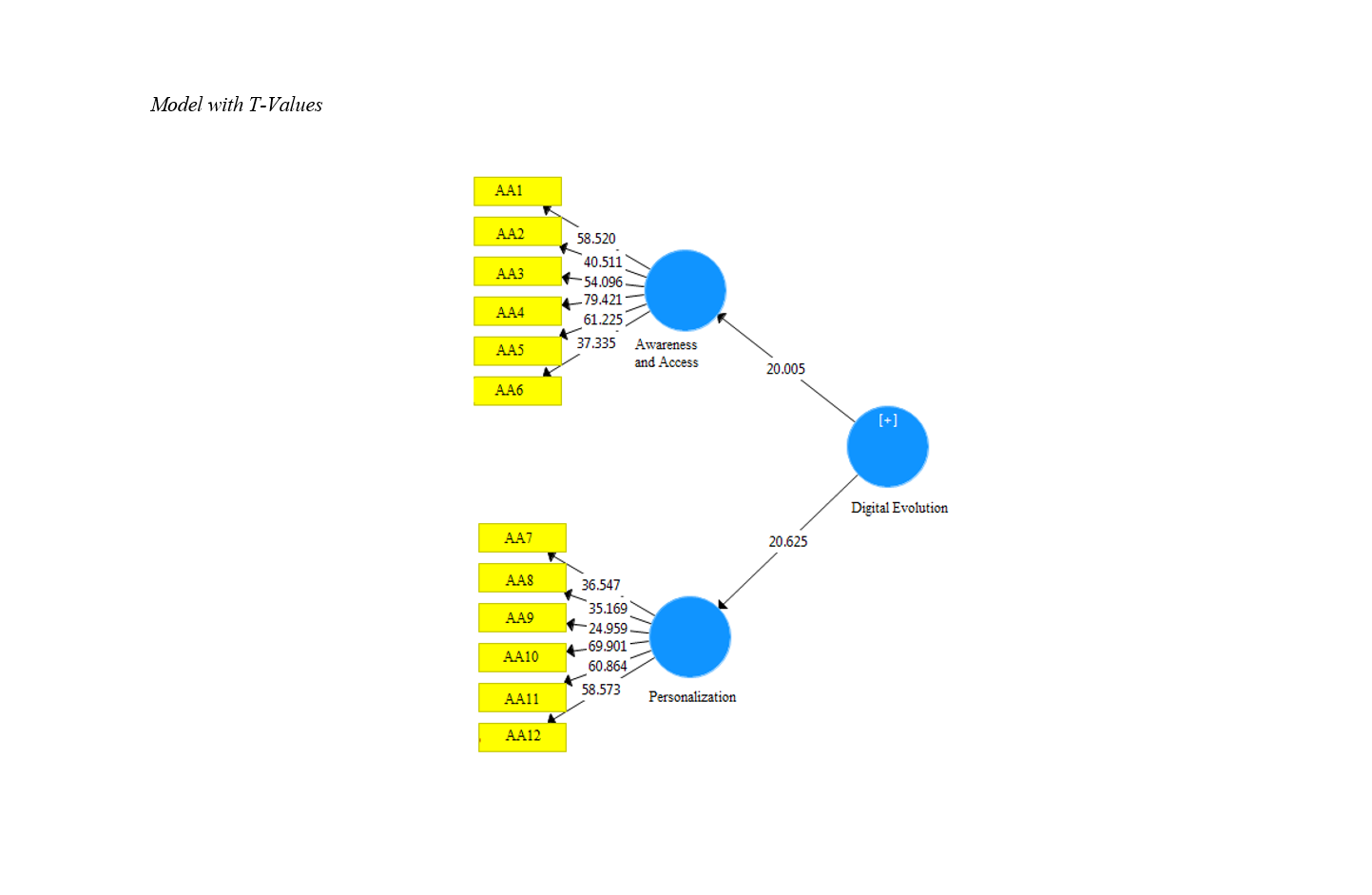

Methodology: The present study is considered to be fundamental-applied research in terms of purpose and survey-based in terms of data collection method. The statistical population of the study included all experts in the insurance industry at Asmari Insurance, who were purposefully selected to theoretical saturation, consisting of 179 individuals for the quantitative section and 15 experts from Asmari Insurance for the qualitative section. Data collection was conducted using thematic analysis and interview tools. For data analysis, qualitative data were analyzed using interview and manual coding, while quantitative data utilized the structural equation modeling approach and Smart PLS3.3 software, including confirmatory factor analysis tests.

Findings: The research results indicate that in the qualitative section, 2 dimensions including access and awareness, and personalization, along with 12 components in the digital transformation of customer experience for insurance products were identified. After conducting the structural model test and overall fit, the desired pattern was confirmed.

Conclusion: It can be concluded that the digital transformation model for customer experience in insurance products has a good fit, and this model can be used in marketing to provide better services to customers.

Downloads

Downloads

Additional Files

Published

Issue

Section

License

Copyright (c) 2024 Mostafa Nikou Goftar, Seyed Abdolla Heydariyeh, Farshad Faezi Razi (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.