Applying Meta-Synthesis Techniques in Identifying Optimization Components of FinTech Based on Artificial Intelligence Indicators in the Financial Market

Keywords:

Fintech optimization, artificial intelligence indicators, financial marketAbstract

Objective: The purpose of this research is to apply the meta-synthesis technique to identify optimization components of FinTech based on artificial intelligence (AI) indicators in the financial market. AI offers the financial industry a unique opportunity to reduce costs, improve customer experience, and increase operational efficiency, among other benefits. Financial companies can provide excellent financial services to their clients. Various features of AI are used by different FinTech companies worldwide to make operations safer and more efficient.

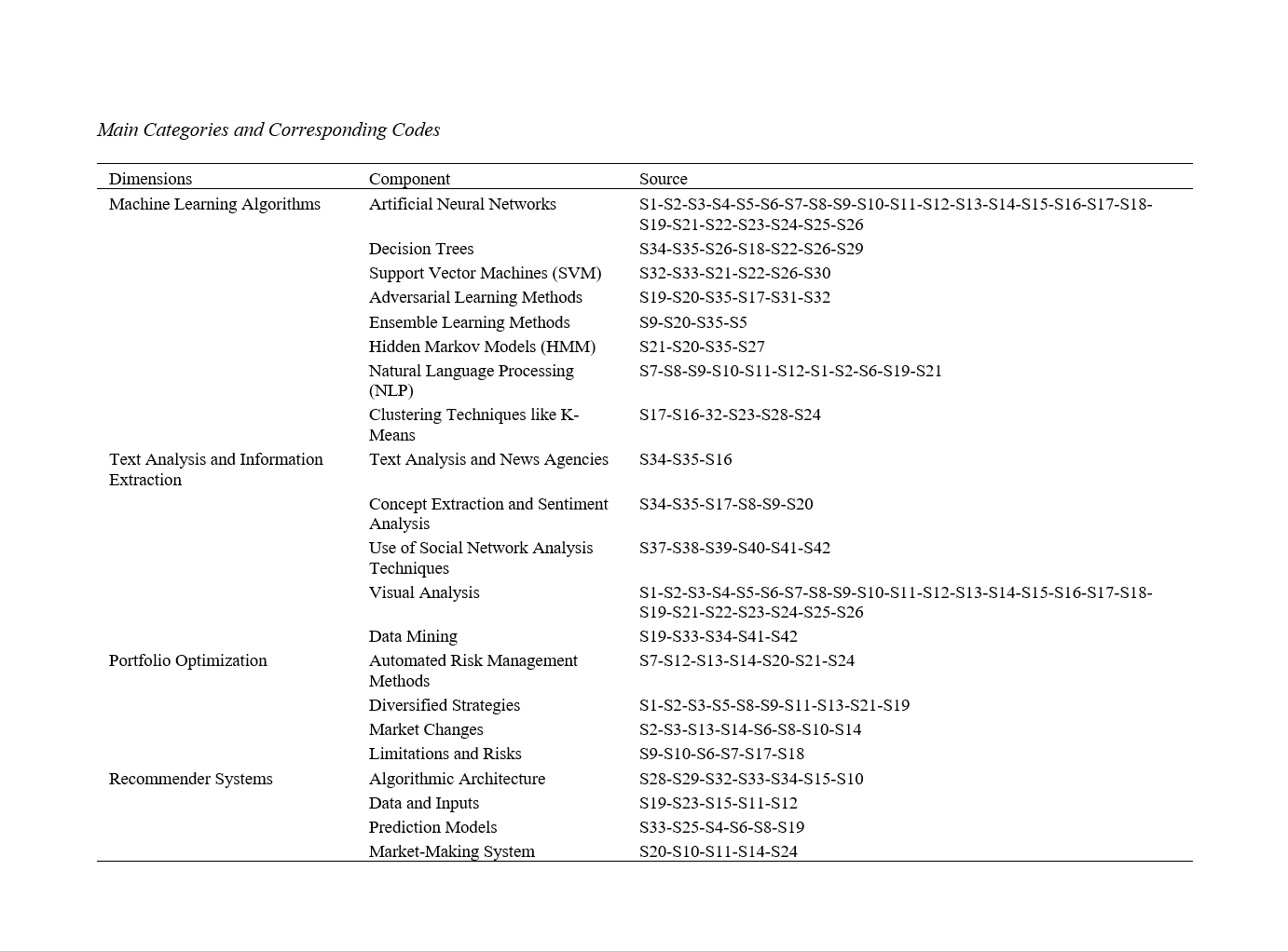

Methodology: The researcher employed a systematic review and meta-synthesis approach to analyze the results and findings of previous researchers. By following the seven-step method of Sandelowski and Barroso, the researcher identified influential factors. Out of 198 articles, 35 were selected based on the CASP method. The validity of the analysis was confirmed using Holsti’s coefficient, Scott’s Pi coefficient, Cohen's kappa index, and Krippendorff's alpha. For reliability measurement and quality control, the transcription method was used, which was found to have an excellent agreement level for the identified indicators. The results from the data analysis, conducted using MAXQDA software, led to the identification of 21 initial codes in four categories.

Findings: Based on the meta-synthesis method, 21 codes were identified in four categories. The validity and reliability of the research findings were confirmed. The identified categories include machine learning algorithms, text analysis and information extraction, portfolio optimization, and recommender systems. In FinTech optimization, one of the fundamental components is machine learning algorithms.

Conclusion: The use of artificial neural networks for predicting market prices, detecting price patterns, and structuring an optimal investment portfolio has significantly improved the performance of capital management systems. Additionally, genetic and evolutionary algorithms have been effective in optimizing parameters and structures of financial models, aiding in achieving optimal investment solutions. However, it is essential to recognize that while AI indicators can enhance financial system performance, one must also be aware of the associated limitations and risks. These include issues such as model complexity, sensitivity to input data, and risks related to machine decision-making.

Downloads

Downloads

Additional Files

Published

Issue

Section

License

Copyright (c) 2024 Esmat Ghasemzadeh (Author); Mohammad Ali Keramati (Corresponding Author); Safia Mehrinejad , Azadeh Mehrani (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.