Presenting an Audit Quality Model Based on Fraud Indicators to Reduce Money Laundering Activities

Keywords:

Audit Quality, Fraud Indicators, Money Laundering Activities, Capital MarketAbstract

Objective: The present study aimed to propose an audit quality model based on fraud indicators to reduce money laundering activities in companies listed on the Iranian capital market.

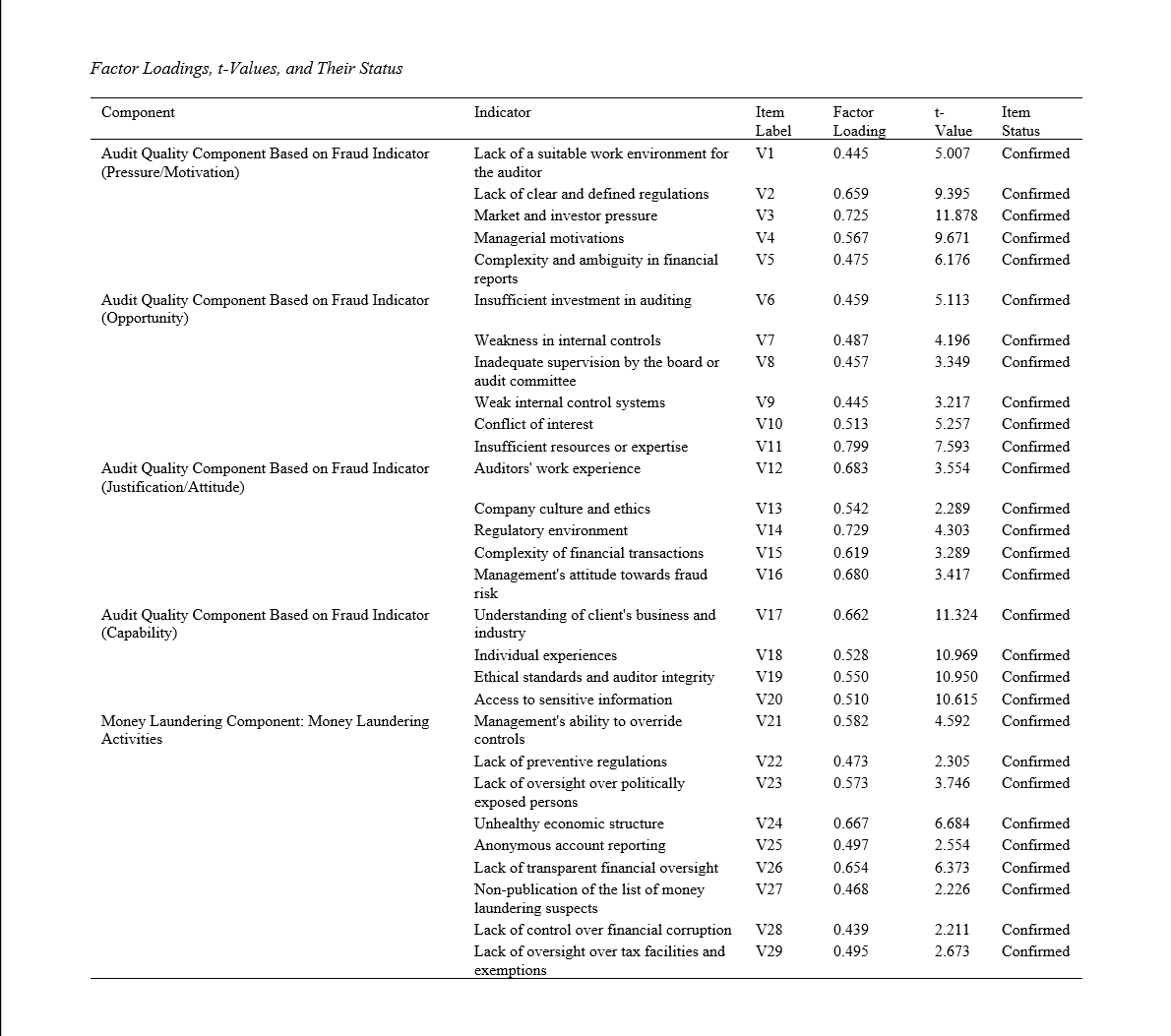

Methodology: The research method was applied in terms of purpose and mixed (qualitative-quantitative) of an exploratory type in terms of data type. The statistical population of the study consisted of the qualitative section (academic experts from the accounting and economics faculty of the University of Tehran) and the quantitative section (senior managers of the Audit Organization, experts from the Tehran Stock Exchange). The sample size in the qualitative section included 16 experts selected using the saturation principle and purposive non-random sampling method. Additionally, in the quantitative section, 185 subjects were selected using stratified random sampling. In the qualitative section of this study, semi-structured interviews were used to collect data, and in the quantitative phase, a researcher-made questionnaire derived from the qualitative section was used. In the qualitative section, for calculating validity, experts' opinions were utilized, and for calculating reliability, intra-subject agreement and inter-coder agreement were used, with results indicating that the data were valid and reliable. Moreover, to determine the validity of the questionnaire, content and construct validity were used, and for calculating reliability, Cronbach's alpha coefficient and composite reliability were used, with results indicating that the tools were valid and reliable. The data analysis method in the qualitative section was thematic analysis using Maxqda 2022 software. In the quantitative section, considering the research objectives, descriptive and inferential statistics methods (one-sample t-test and confirmatory factor analysis) were used with Spss-V23 and Smart PLS software.

Findings: The research findings showed that audit quality variables based on fraud indicators in the Tehran Stock Exchange, including pressure, opportunity, justification, and capability, had path coefficients of 0.291; 0.231; 0.263; and 0.120, respectively, impacting the reduction of money laundering activities. Finally, based on the obtained results, the research model was designed, which had appropriate validity.

Conclusion: The study highlights that high-quality auditing based on fraud indicators significantly reduces money laundering activities in companies listed on the Tehran Stock Exchange. Key audit quality variables—pressure/motivation, opportunity, justification/attitude, and capability—directly and significantly impact the effectiveness of anti-money laundering measures. Strengthening auditing mechanisms, improving internal controls, and fostering cooperation between auditing authorities and regulatory bodies are crucial strategies to mitigate money laundering.

Downloads

Downloads

Additional Files

Published

Issue

Section

License

Copyright (c) 2024 Narges Hoseinaei (Author); Habibollah Nakhaei (Corresponding Author); Zohreh Hajiha, Karim Nakhaei (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.