Modeling FinTech Variables in the Insurance Industry

Keywords:

Fintech, Insurance Industry, ModelingAbstract

Objective: The primary objective of this study is to model the impact of FinTech variables on the profitability of the insurance industry.

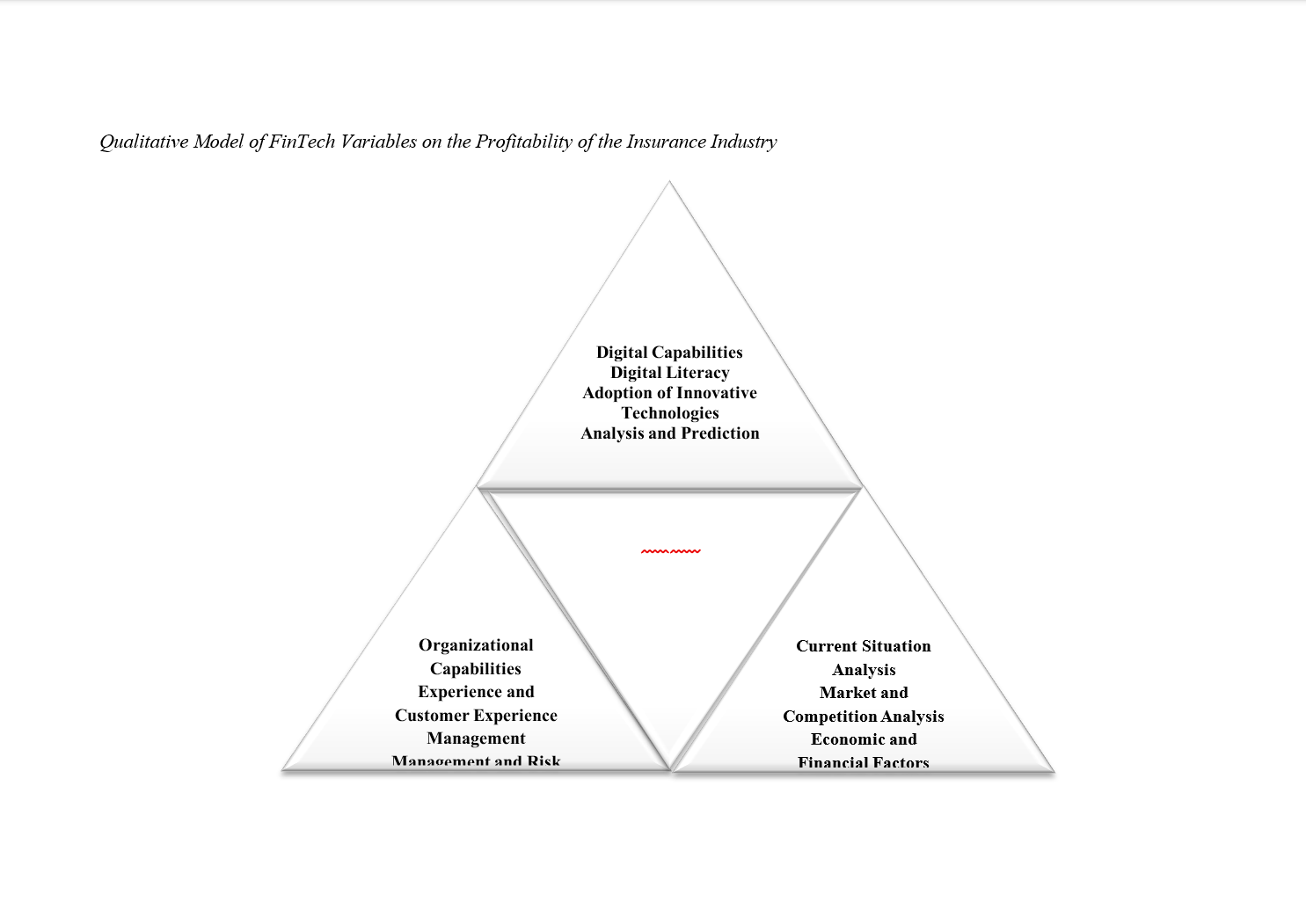

Methodology: This study utilizes a sequential exploratory mixed-method approach. In the qualitative phase, data was collected through interviews with experts in the insurance and FinTech industries, along with a review of scientific literature. The data was analyzed using MAXQDA software to develop a qualitative model of FinTech variables affecting profitability. The second phase employed a quantitative approach, where developed tools were tested on a selected sample for validation and further analysis. The model was then evaluated based on qualitative and quantitative findings, with a causal loop diagram illustrating the interactions between key variables.

Findings: The research identified three key FinTech-related variables: digital literacy, adoption of innovative technologies, and analysis and prediction. These variables form a positive feedback loop, enhancing digital and organizational empowerment. Findings show that FinTech adoption leads to increased operational efficiency, cost reduction, and improved risk assessment, which in turn boosts profitability for insurance companies. Additionally, collaboration with InsurTech startups and the integration of advanced technologies such as artificial intelligence (AI) and blockchain were found to be critical in maintaining competitive advantages and meeting evolving customer expectations.

Conclusion: The study concludes that FinTech represents both a challenge and an opportunity for the insurance industry. Insurers must modernize their processes and adopt innovative technologies to remain competitive and responsive to market changes. The positive interaction between digital literacy, technological adoption, and market analysis strengthens the industry’s ability to enhance customer experience and profitability. Traditional insurance companies are encouraged to collaborate with FinTech and InsurTech startups, optimize business processes, and align with regulatory frameworks to effectively utilize FinTech innovations.

Downloads

References

Abbas, A. (2024). Marketing Agility’s Influence on Market Performance: A Perspective From FinTech Industry. Abbdm, 4(02). https://doi.org/10.62019/abbdm.v4i02.165

Abtahi, S. Y., & Azadineghad, A. (2019). Threshold Cointegration of the Stock Market Returns and Currency and Gold Markets in Iran. Financial Engineering and Portfolio Management, 10(38), 1-18. https://sanad.iau.ir/en/Article/1079230

Almulla, D., & Aljughaiman, A. A. (2021). Does Financial Technology Matter? Evidence from an Alternative Banking System. Cogent Economics & Finance, 9(1), 1934978. https://doi.org/10.1080/23322039.2021.1934978

Alzwi, A. S., Jaber, J. J., Rohuma, H. N., & Omari, R. A. (2024). Evaluation of Total Risk-Weighted Assets in Islamic Banking through Fintech Innovations. Journal of Risk and Financial Management, 17(7). https://doi.org/10.3390/jrfm17070288

Bahrami, A., Haghighi Kafash, M., & Hajikarimi, B. (2022). Presenting a Marketing Model for Insurance Technology (Insurtech) for Startups in the Insurance Industry. Modern Marketing Research Journal, 12(1), 197-216. https://nmrj.ui.ac.ir/article_26771.html

Cao, L., Yang, Q., & Yu, P. S. (2021). Data science and AI in FinTech: an overview. International Journal of Data Science and Analytics, 12(2), 81-99. https://doi.org/10.1007/s41060-021-00278-w

Fernando, F., & Dharmastuti, C. F. (2021). Fintech: The Impact of Technological Innovation on the Performance of Banking Companies Surakarta, Indonesia. http://ieomsociety.org/proceedings/2021indonesia/161.pdf

Feyen, E., Frost, J., Gambacorta, L., Natarajan, H., & Saal, M. (2021). Fintech and the Digital Transformation of Financial Services: Implications for Market Structure and Public Policy. https://www.bis.org/publ/bppdf/bispap117.htm

Gholami, M., Zanjirdar, M., Ghaffari Ashtiani, P., & Haji, G. (2022). Presenting a Model for Implementing Fintech in the Banking Industry of Iran. Advances in Financial and Investment Studies, 3(7), 23-46. https://www.google.com/url?sa=t&source=web&rct=j&opi=89978449&url=https://sanad.iau.ir/fa/Journal/afi/DownloadFile/1088274&ved=2ahUKEwist4rNt6KJAxUvhP0HHSvELwUQFnoECBIQAQ&usg=AOvVaw3mke0K3_lfSzGaYCO-Y_q2

Gomber, P., Koch, J. A., & Siering, M. (2017). Digital Finance and FinTech: Current Research and Future Research Directions. Journal of Business Economics, 87, 537-580. https://doi.org/10.1007/s11573-017-0852-x

Gupta, A., & Arora, N. (2017). Consumer Adoption of M-Banking: A Behavioral Reasoning Theory Perspective. International Journal of Bank Marketing, 35, 733-747. https://doi.org/10.1108/IJBM-11-2016-0162

Haber, J., D'Yakonova, I., & Milchakova, A. (2018). Estimation of Fintech Market in Ukraine in Terms of Global Development of Financial and Banking Systems. Public and Municipal Finance, 7(2), 14-23. https://doi.org/10.21511/pmf.07(2).2018.02

Haghighi Kafash, M., Bahrami, Amir, Haji Karimi, Babak. (2022). Providing a Marketing Model Insurance Technology ‘Insurtech’ for Start-up Businesses in the Insurance Industry. New Marketing Research Journal, 12(1), 197-216. https://doi.org/10.22108/nmrj.2022.131270.2577

Halteh, K., Alkhouri, R., Ziadat, S., & Haddad, F. (2024). Fintech Unicorns Forecaster: An AI Approach For Financial Distress Prediction. Migration Letters, 21(S4), 942-954. https://migrationletters.com/index.php/ml/article/download/7379/4801/19544

Jin, H. F., Li, H. J., & Liu, Y. L. (2020). Financial Technology, Bank Risk and Market Crowding Out Effect. Financial Research, 46(5), 1-14. https://qks.sufe.edu.cn/J/CJYJ/Article/Details/A23adfb33-d164-4af9-907b-7f5f757fbb5c

Kelley, C., & Wang, K. (2021). InsurTech: A guide for the actuarial community. Society of Actuaries. https://www.soa.org/49bb46/globalassets/assets/files/resources/research-report/2021/insurtech-guide-community.pdf

Khazaei, H., Fa'ezi Razi, F., & Vakil-ol-Ra'aya, Y. (2022). Presenting a Model for the Acceptance of Fintech Products and Services by Customers of Iranian Banks. Islamic Economics and Banking Journal, 11(38), 249-280. https://mieaoi.ir/article-1-1029-en.html

Kou, G., Chao, X., Peng, Y., Alsaadi, F. E., & Herrera-Viedma, E. (2019). Machine Learning Methods for Systemic Risk Analysis in Financial Sectors. Technological and Economic Development of Economy, 25(5), 716-742. https://doi.org/10.3846/tede.2019.8740

Lim, S. H., Kim, D. J., Hur, Y., & Park, K. (2019). An Empirical Study of the Impacts of Perceived Security and Knowledge on Continuous Intention to Use Mobile Fintech Payment Services. International Journal of Human-Computer Interaction, 35, 886-898. https://doi.org/10.1080/10447318.2018.1507132

Liu, J., Ye, Shujun, Zhang, Yujin, Zhang, Lulu. (2023). Research on InsurTech and the technology innovation level of insurance enterprises. Sustainability, 15(11), 8617. https://www.mdpi.com/2071-1050/15/11/8617

Lv, S., Du, Y., & Liu, Y. (2022). How Do Fintechs Impact Banks' Profitability?-An Empirical Study Based on Banks in China. Fintech, 1(2), 155-163. https://doi.org/10.3390/fintech1020012

Nurlaela, N., Luthfiyana, M., Sulastri, A., & Wahyunita, E. S. (2020). Reviewing the Fatwas Related to FinTech Applications in Islamic Financial Institutions in Indonesia. Share: Jurnal Ekonomi Dan Keuangan Islam, 9(2), 206-226. https://doi.org/10.22373/share.v9i2.7989

Parsamanesh, A., Mehrani, H., Vahabzadeh Manshi, S., & Hassan Moradi, N. (2021). Designing a Model for the Adoption of Insurance Technology (Insurtech) Using Structural-Interpretive Modeling. Insurance Research Journal, 36(4), 101-134. https://ijir.irc.ac.ir/article_134710.html

Pauch, D., Bera, Anna. (2022). Digitization in the insurance sector – challenges in the face of the Covid-19 pandemic. Procedia Computer Science, 207(no), 1677-1684. https://doi.org/10.1016/j.procs.2022.09.225

Ranjandish, N., Damankeshideh, M., Momeni Vesalian, H., & Afsharirad, M. (2020). The Effects of Monetary and Fiscal Policies on the Systemic Risk of Iran's Financial Markets (SURE Approach in Panel Data). Iranian Journal of Finance, 4(1), 1-24. https://www.ijfifsa.ir/article_113332.html

Shoetan, P. O. (2024). Transforming Fintech Fraud Detection With Advanced Artificial Intelligence Algorithms. Finance & Accounting Research Journal, 6(4), 602-625. https://doi.org/10.51594/farj.v6i4.1036

Suseendran, G., Chandrasekaran, E., Akila, D., & Sasi Kumar, A. (2020). Banking and FinTech (Financial Technology) Embraced with IoT Device. In Data Management, Analytics and Innovation: Proceedings of ICDMAI 2019, Volume 1 (pp. 197-211). Springer Singapore. https://doi.org/10.1007/978-981-32-9949-8_15

Wang, Q. (2021). THE IMPACT OF INSURTECH ON CHINESE INSURANCE INDUSTRY. Procedia Computer Science, 187, 30-35. https://doi.org/10.1016/j.procs.2021.04.030

Wang, T., Zhang, X., Ma, Y., & Wang, Y. (2023). Risk Contagion and Decision-Making Evolution of Carbon Market Enterprises: Comparisons with China, the United States, and the European Union. Environmental Impact Assessment Review, 99, 107036. https://doi.org/10.1016/j.eiar.2023.107036

Zaghlol, A. K., Ramdhan, N. A., & Othman, N. (2021). The Nexus Between FinTech Adoption and Financial Development in Malaysia: An Overview. Global Business & Management Research, 13(4). https://www.researchgate.net/publication/356194561_The_Nexus_between_FinTech_Adoption_and_Financial_Development_in_Malaysia_An_Overview

Downloads

Additional Files

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2024 Arash Khorshidi (Author); Farid Sefati (Corresponding Author); Alireza Ghiyasvand (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.