Examining the Effect of Interest Rate Suppression on Credit Risk in the Banking Industry with a Focus on Financial Inclusion: A Simultaneous Equations Approach

Keywords:

Interest rate suppression, Financial inclusion, Credit risk, Banking industry, Financial modellingAbstract

Objective: This study aims to examine the impact of interest rate suppression on credit risk in the banking industry, focusing on the moderating role of financial inclusion.

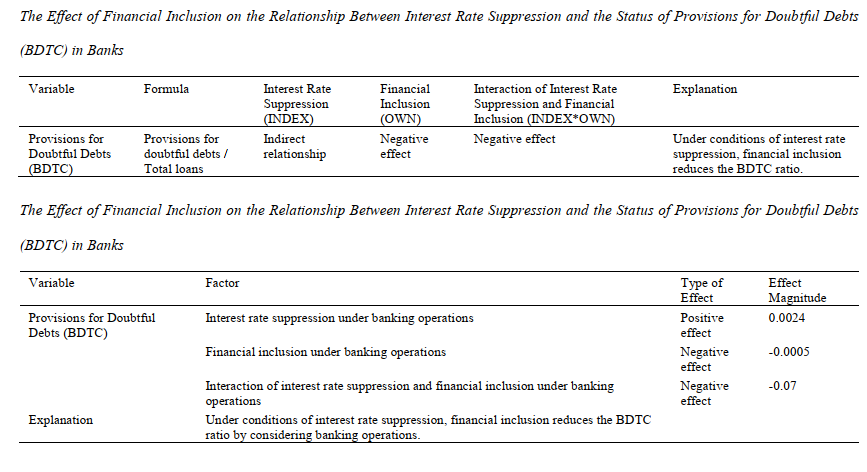

Methodology: The study employed a two-stage least squares (2SLS) approach within a simultaneous equations framework, using panel data from 15 banks listed on the Tehran Stock Exchange over a nine-year period (2014–2022). Key variables, including non-performing loans (NPL), provisions for doubtful debts (BDTC), interest rate suppression (INDEX), and financial inclusion (OWN), were analyzed. Interaction terms were included to assess the moderating effects of financial inclusion on the relationship between interest rate suppression and credit risk.

Findings: The results indicate that interest rate suppression negatively affects both the NPL and BDTC ratios, with significant reductions of 0.05% and 0.08%, respectively, for a 1% increase in the suppression index. Financial inclusion reduces the NPL ratio by 0.04% and the BDTC ratio by 0.05% per 1% increase in financial inclusion, contributing to a more stable banking environment. Furthermore, the interaction of interest rate suppression and financial inclusion mitigates credit risks, reducing the NPL ratio by 0.03% and the BDTC ratio by 0.07% for a 1% increase in the interaction term.

Conclusion: Interest rate suppression and financial inclusion exhibit contrasting effects on banking stability. While interest rate suppression decreases profitability and alters lending behaviors, financial inclusion mitigates credit risk by diversifying lending practices and expanding access to financial services. Policymakers should prioritize balancing interest rate policies with initiatives to enhance financial inclusion to stabilize and strengthen the banking system.

Downloads

References

Akbarinejad Taghdimi, S. (2022). The Impact of Social Responsibility on Financial Performance, Financial Stability, and Financial Inclusion with the Mediating Role of Citizenship Performance (Case Study: Refah Bank). First National Conference on Innovation in Management, Accounting, and Economics Research,

Balonjad Nouri, R., & Shajari Pour, S. (2022). The Effect of Banking Competition on Financial Inclusion. Semi-Annual Journal of Development and Investment, 7(1). https://civilica.com/doc/1492315/

Gulcay, T., & Hamed Ahmad, A. (2021). Does interest rate and its volatility affect banking sector development? Empirical evidence from emerging market economies. Research in International Business and Finance, 58, 101436. https://doi.org/10.1016/j.ribaf.2021.101436

Hassan, M. K., Sanchez, B., & Yu, J. S. (2011). Financial development and economic growth: New evidence from panel data. The Quarterly Review of Economics and Finance, 51(1), 88-104. https://doi.org/10.1016/j.qref.2010.09.001

Heidari Dizgarani, A. (2014). Examining Financial Sustainability and Financial Shocks in Iran Razi University]. https://www.sid.ir/paper/229147/fa

Hosseinidoust, S. E., & Saatian, A. (2020). The effect of financial repression policy on bank liquidity risk (evidence from Central Bank of Iran). Afro-Asian Journal of Finance and Accounting. https://www.researchgate.net

Jamir, I. (2024). Impact of global financial crisis on Indian handicrafts exports: A breakpoint analysis. Global Business Review, 25(2_suppl), S103-S120. https://doi.org/10.1177/0972150920954612

Kamalvand, K., & Nazanini, K. (2019). Identifying the Effects of Interest Rate Changes on Economic Stability and Banking Health. Third International Conference on Modern Developments in Management, Economics, and Accounting,

Kamijani, A., Ebadi, J., & Pour Rostami, N. (2008). Financial Liberalization and Its Role in Financial Development Considering Institutional and Legal Development (A Comparison of Less Developed and Emerging Countries). Mofid Monthly, 14(69). https://economic.mofidu.ac.ir/article_47794.html

Karimi, M. (2022). Examining the Impact of Financial Inclusion on Government Tax Revenues Using the ARDL Statistical Method. Seventeenth National Conference on New Approaches in Management, Economics, and Accounting,

Mekki, H. (2017). Financial liberalization and systemic banking crises: A meta-analysis. International Economics, 152, 26-54. https://doi.org/10.1016/j.inteco.2017.08.002

Mekki, H., & Samir, M. (2020). Financial reforms and banking system vulnerability: The role of regulatory frameworks. Structural Change and Economic Dynamics, 52, 184-205. https://doi.org/10.1016/j.strueco.2019.10.007

Mousavi, S., Bastani Far, I., & Amiri, H. (2021). The Impact of Mandated Deposit Rate Changes on Banking Financial Stability in Iran Under Sanctions. Economics and Modeling, 11(4), 1-26. https://ecoj.sbu.ac.ir/article_101269.html

Najafi, S. M. B., Fathollahi, J., & Mohammadpour, F. (2019). The Role of Good Governance in Achieving a Knowledge-Based Economy in Iran (Using the Quadruple Helix Model). Economic Research Quarterly (Growth and Sustainable Development), 9(1), 129-158. http://ensani.ir/fa/article/403518/%D9%86%D9%82%D8%B4-%D8%AD%DA%A9%D9%85%D8%B1%D8%A7%D9%86%DB%8C-%D8%AE%D9%88%D8%A8-%D8%AF%D8%B1-%D8%AA%D8%AD%D9%82%D9%82-%D8%A7%D9%82%D8%AA%D8%B5%D8%A7%D8%AF-%D8%AF%D8%A7%D9%86%D8%B4-%D8%A8%D9%86%DB%8C%D8%A7%D9%86-%D8%AF%D8%B1-%D8%A7%DB%8C%D8%B1%D8%A7%D9%86-%D8%AF%D8%B1-%D9%82%D8%A7%D9%84%D8%A8-%D9%85%D8%AF%D9%84-%D9%85%D8%A7%D8%B1%D9%BE%DB%8C%DA%86-%DA%86%D9%87%D8%A7%D8%B1%DA%AF%D8%A7%D9%86%D9%87-

Nazarian, R., Farhadipour, M. R., & Faraji, A. (2013). The Impact of Competition in the Banking Industry on the Effectiveness of Monetary Policy Transmission Through the Bank Lending Channel. Ravand Quarterly, 20(61-62), 43-74. https://www.magiran.com/paper/1280319/%D8%AA%D8%A7%D8%AB%DB%8C%D8%B1-%D8%B1%D9%82%D8%A7%D8%A8%D8%AA-%D8%AF%D8%B1%D8%B5%D9%86%D8%B9%D8%AA-%D8%A8%D8%A7%D9%86%DA%A9%D8%AF%D8%A7%D8%B1%DB%8C-%D8%A8%D8%B1-%D8%A7%D8%AB%D8%B1%D8%A8%D8%AE%D8%B4%DB%8C-%D8%A7%D9%86%D8%AA%D9%82%D8%A7%D9%84-%D8%A2%D8%AB%D8%A7%D8%B1-%D8%B3%DB%8C%D8%A7%D8%B3%D8%AA-%D9%BE%D9%88%D9%84%DB%8C-%D8%A7%D8%B2-%D8%B7%D8%B1%DB%8C%D9%82-%DA%A9%D8%A7%D9%86%D8%A7%D9%84-%D9%88%D8%A7%D9%85-%D8%AF%D9%87%DB%8C-%D8%A8%D8%A7%D9%86%DA%A9

Nie, Y. (2023). A Macroprudential Analysis of the 2008 Financial Crisis. Advances in Economics Management and Political Sciences, 37(1), 55-60. https://doi.org/10.54254/2754-1169/37/20231832

Rahmani, T., Mehrara, M., Cheraghloo, A., & Shakeri, G. (2018). The Impact of Competition in the Banking System and Capital Requirements on the Risk-Taking of Iranian Banks. Economic Research, 53(1), 25-44. http://ensani.ir/fa/article/500347/%D8%AA%D8%A3%D8%AB%DB%8C%D8%B1-%D8%AF%D8%B1%D8%AC%D9%87-%DB%8C-%D8%B1%D9%82%D8%A7%D8%A8%D8%AA-%D8%AF%D8%B1-%D8%B3%DB%8C%D8%B3%D8%AA%D9%85-%D8%A8%D8%A7%D9%86%DA%A9%DB%8C-%D9%88-%D8%A7%D9%84%D8%B2%D8%A7%D9%85%D8%A7%D8%AA-%D8%B3%D8%B1%D9%85%D8%A7%DB%8C%D9%87-%D8%A7%DB%8C-%D8%A8%D8%B1-%D9%85%DB%8C%D8%B2%D8%A7%D9%86-%D8%B1%DB%8C%D8%B3%DA%A9-%D9%BE%D8%B0%DB%8C%D8%B1%DB%8C-%D8%A8%D8%A7%D9%86%DA%A9-%D9%87%D8%A7%DB%8C-%D8%A7%DB%8C%D8%B1%D8%A7%D9%86

Sevilla, J., Ruiz-Martin, C., Nebro, J. J., & Lopez-Paredes, A. (2025). Resilience of Spanish Firms: a comparative analysis of large and small businesses in the face of 2008 financial crisis and COVID-19. International Journal of Production Management and Engineering, 13(1), 45-58. https://doi.org/10.4995/ijpme.2025.21740

Shahabadi, A., Moradi, A., & Momivand, G. (2021). The Cross-Effect of Financial Development and Good Governance on Innovation in Efficiency-Oriented Countries. Journal of Innovation Management, 9(4), 67-88. https://www.magiran.com/paper/2283634/%d8%a7%d8%ab%d8%b1-%d9%85%d8%aa%d9%82%d8%a7%d8%b7%d8%b9-%d8%aa%d9%88%d8%b3%d8%b9%d9%87-%d9%85%d8%a7%d9%84%db%8c-%d9%88-%d8%ad%da%a9%d9%85%d8%b1%d8%a7%d9%86%db%8c-%d8%ae%d9%88%d8%a8-%d8%a8%d8%b1-%d9%86%d9%88%d8%a2%d9%88%d8%b1%db%8c-%d8%af%d8%b1-%da%a9%d8%b4%d9%88%d8%b1%d9%87%d8%a7%db%8c-%d9%85%d9%86%d8%aa%d8%ae%d8%a8-%da%a9%d8%a7%d8%b1%d8%a7%db%8c%db%8c-%d9%85%d8%ad%d9%88%d8%b1

Taheri, H. R., Piri, P., Naderi, A., & Esmaily, N. (2023). Forecasting The Financial Crisis in Iran According to The Slope of The Yield Curve and The Bank Credit Index: A Machine Learning. Approach. Iranian Journal of Economic Studies, 12(1), 217-248. https://doi.org/10.22099/ijes.2024.51275.1973

Yousefi Ghaleroudkhani, M. A., Tehrani, R., & Mirlouhi, S. M. (2021). Examining the Impact of Financial Performance Criteria on the Financial Sustainability of Banks During Financial Crises. Modares Humanities Quarterly (Management Research in Iran), 25(2), 1-21. https://mri.modares.ac.ir/article_554.html

Downloads

Additional Files

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Elahe Zafari (Author); Mahdi Madanchi Zaj (Corresponding Author); Hamidreza Vakili Fard, Maryam Khalili Araghi (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.