Structural Modeling of Risk-Taking Behaviors Based on Attention Systems with the Mediating Role of Emotion Regulation in Substance Users

Keywords:

Risk-taking behaviors, Attention, Emotion regulation, Substance useAbstract

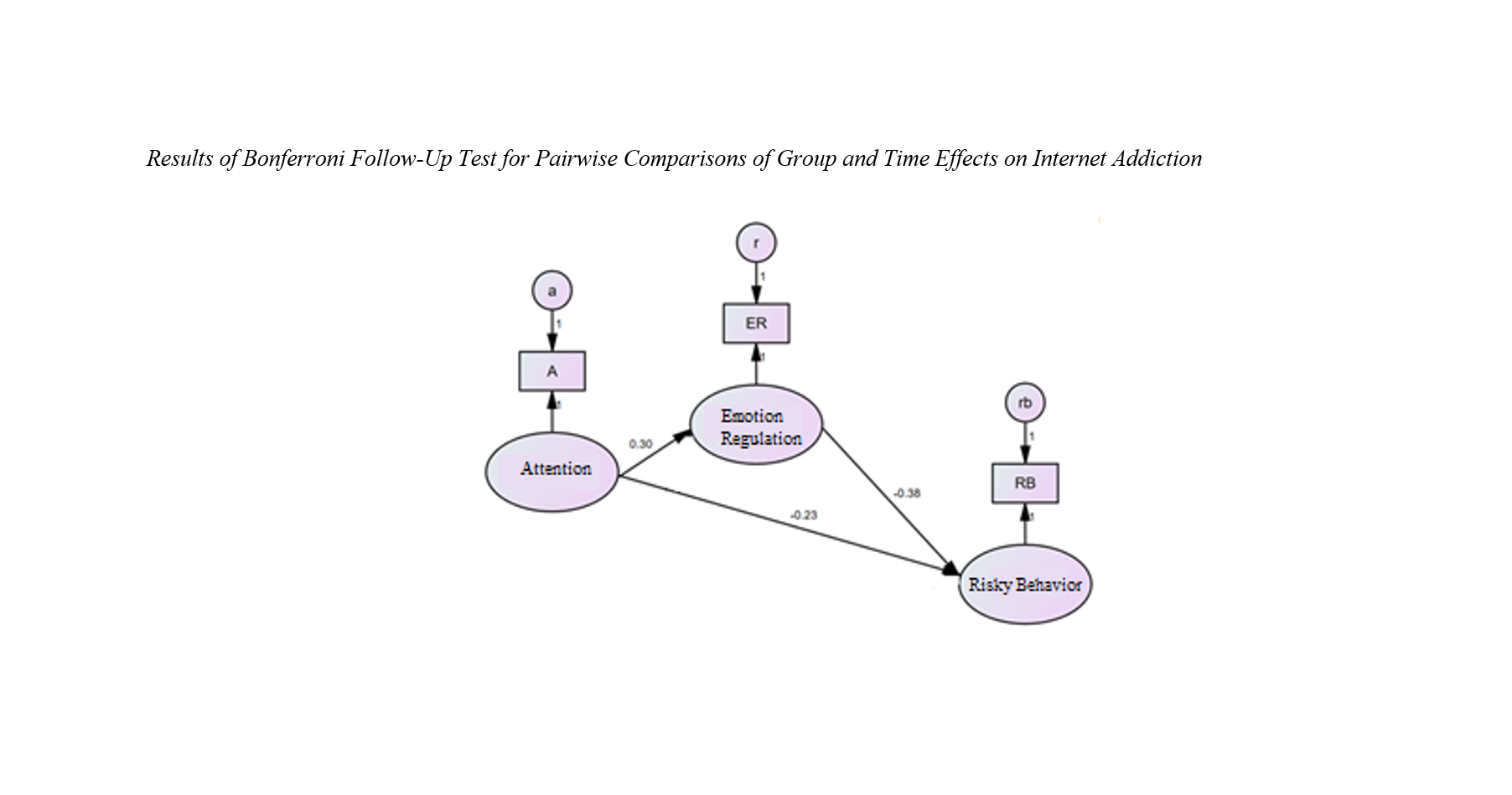

Objective: The aim of the current study was to determine the structural model of risk-taking behaviors based on the attention system with the mediating role of emotion regulation among substance users.

Methods and Materials: This research was a descriptive-correlational study using structural equation modeling. The population included all marijuana users in Isfahan who visited addiction treatment centers in 2023. The sample comprised 250 marijuana users selected via convenience sampling based on inclusion and exclusion criteria. Data were collected using cognitive training software for attention and memory, the Cognitive Emotion Regulation Questionnaire (CERQ), and a risky behavior questionnaire. Descriptive statistics such as mean and standard deviation were used to organize, summarize, and describe the data on participant characteristics and research variables. In the inferential statistics section, structural equation modeling and Pearson correlation methods were employed to analyze the data using SPSS 22 and AMOS 22.

Findings: The model fit indices PCFI = 0.599, PNFI = 0.611, CMIN/DF = 2.88, RMSEA = 0.072, IFI = 0.913, CFI = 0.920, and GFI = 0.909 indicated a good fit of the proposed model with the data. Thus, the proposed model exhibited satisfactory fit.

Conclusion: Therefore, it can be concluded that the structural model of risk-taking behaviors based on the attention system with the mediating role of emotion regulation is appropriate for substance users.

Downloads

Downloads

Additional Files

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2024 Vahid Rezaei Kachi (Corresponding Author); Elham Foroozandeh, Fatemeh Sadat Tabatabaei Nejad, Seyed Mostafa Banitaba (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.