Institutional Isomorphism Model and Its Impact on Environmental, Social, and Corporate Governance Reporting

Keywords:

Institutional isomorphism model, coercive isomorphism, normative isomorphism, mimetic isomorphism, environmental reporting, social reporting, corporate governance reportingAbstract

Objective: The aim of this research is to present an institutional isomorphism model and examine its impact on environmental, social, and corporate governance reporting.

Methodology: This study employs a mixed-methods approach, conducted simultaneously. The quantitative part is descriptive-survey and correlational, with data collected from 385 managers of publicly traded companies on the Tehran Stock Exchange through a questionnaire. The data were analyzed using LISREL software. In the second part of the study, a qualitative approach using ethnography and purposive sampling was employed to collect data from individuals holding doctoral degrees in accounting and working in publicly traded companies on the Tehran Stock Exchange. The data were analyzed using thematic analysis and content analysis methods.

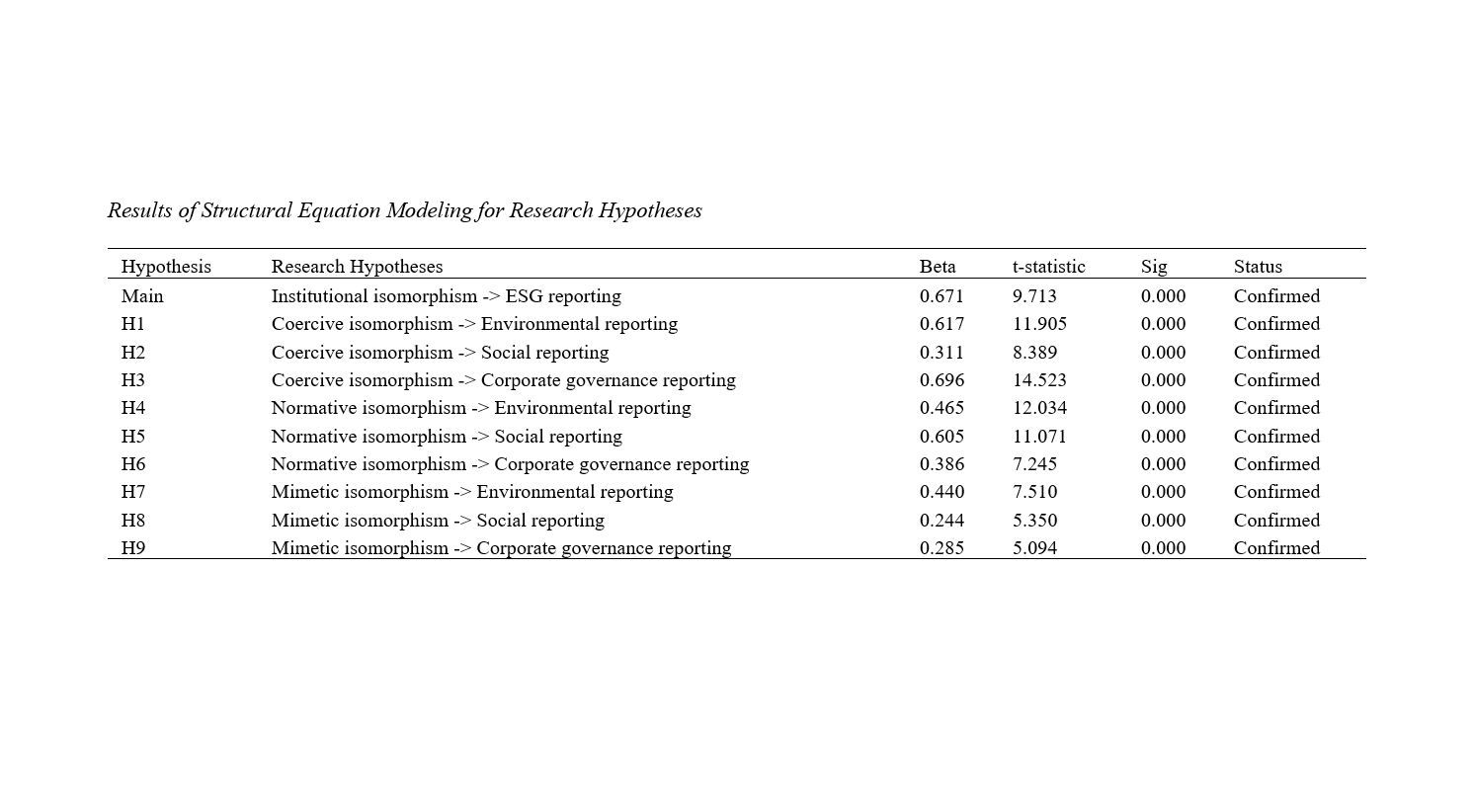

Findings: Based on the findings of the first study, the institutional isomorphism factors (coercive, normative, and mimetic) explain 65.9% of the variance in environmental, social, and corporate governance reporting. Additionally, in the second study, after conducting interviews with 10 participants, a total of 33 categories were identified during the open coding phase, which were considered as the main categories. The category of labor rights had the most repetitions in the interviews, and the categories of performance compensation, labor rights, and corporate social responsibility investment were repeated in all interviews. During the axial coding phase, the 33 main categories were classified into four categories: social dimension, corporate governance, environmental dimension, and finally, institutional isomorphism. The environmental dimension, with 10 main categories and 96 repetitions in the interviews, had the highest number of repetitions, with the categories of corporate social responsibility investment, biodiversity, and environmental issues in products, services, and supply chains being the most important from the interviewees’ perspectives. The social dimension, with 11 main categories and 183 repetitions, had the highest frequency, with the categories of labor rights, social issues related to customers and the supply chain, stakeholder social perceptions, and health, safety, and productivity being the most important. Finally, the corporate governance dimension, with 9 main categories and 105 repetitions, had the most importance in the interviews, with the categories of investment risk management and performance compensation being the most significant. In the selective coding phase, the social dimension, with 11 main categories, was introduced as the central category.

Conclusion: This study highlights the critical role of institutional pressures—coercive, normative, and mimetic—in shaping sustainability assurance practices. By addressing legal, cultural, and industry-specific factors, it underscores assurance as a vital tool for legitimacy and stakeholder alignment. The findings advance institutional theory and offer practical insights for policymakers, companies, and stakeholders.

Downloads

Downloads

Additional Files

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2024 Saeed Mohammadnezhad (Author); Samad Ayazi (Corresponding Author); Arash Naderian (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.