Investigating the Effect of Board Characteristics and CEO Tenure on Audit Quality in Companies Listed on the Iraq and Qatar Stock Exchanges: A Comparative Approach

Keywords:

Iraq and Qatar, Audit quality, CEO tenure , board characteristicsAbstract

Objective: This study aims to examine the impact of board characteristics and CEO tenure on audit quality in companies listed on the Iraq and Qatar stock exchanges, with a comparative analysis of these two emerging markets.

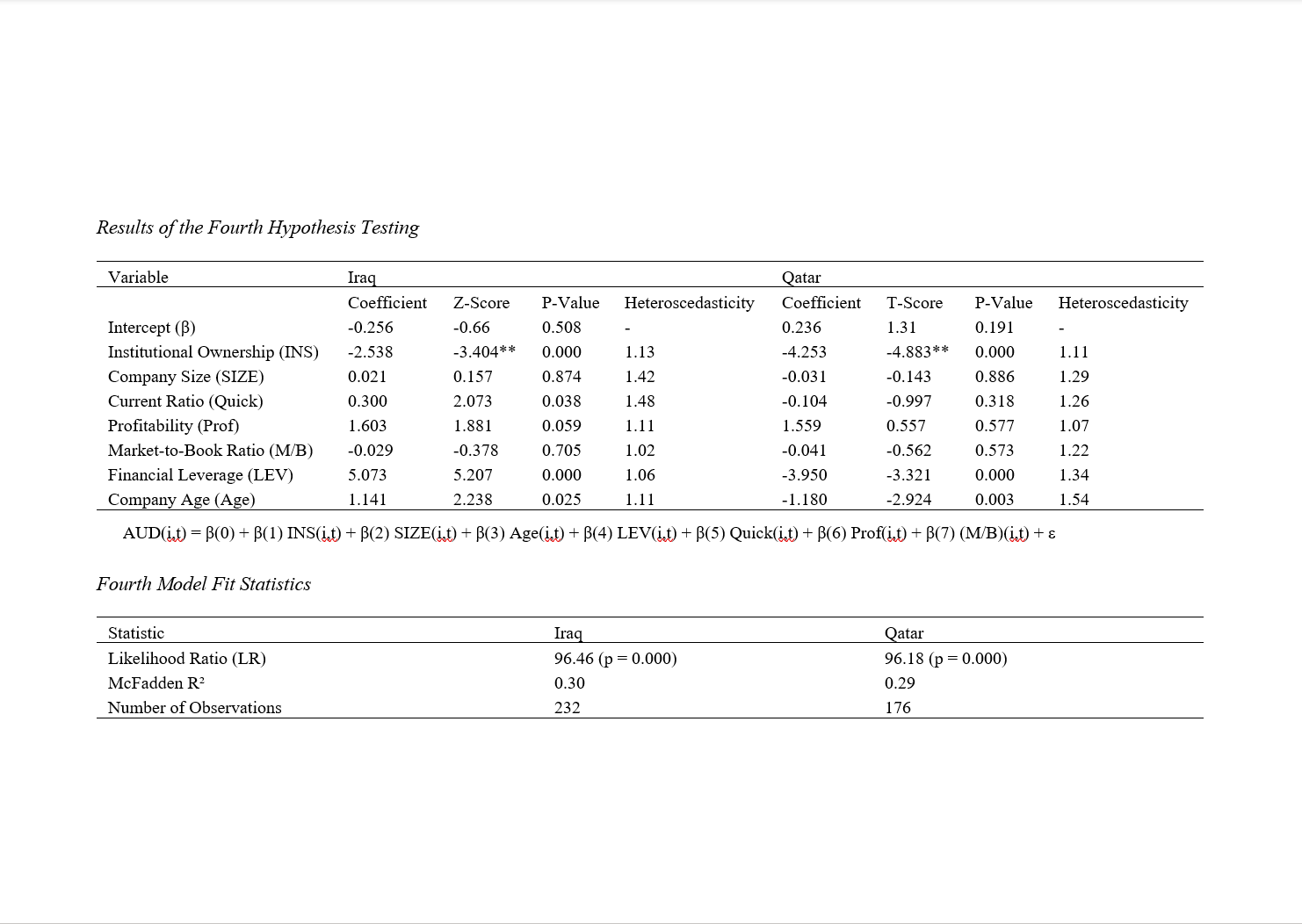

Methodology: The study employs a quantitative resesarch design using panel data regression analysis to assess the relationships between board size, board independence, CEO tenure, and institutional ownership with audit quality. The research sample consists of 232 firm-year observations from Iraq and 176 firm-year observations from Qatar, covering the period 2015 to 2022. Data were collected from financial statements and corporate reports of publicly listed companies. To ensure robustness, unit root tests, variance heterogeneity tests (White test), and multicollinearity diagnostics (VIF values) were conducted before hypothesis testing. The hypotheses were tested using regression models based on McFadden’s logit estimation, and model fit was evaluated through Likelihood Ratio (LR) statistics and McFadden's R² values.

Findings: The results indicate a significant positive relationship between board size and audit quality in Iraq, whereas no significant relationship was found in Qatar. Board independence positively and significantly influences audit quality in both countries. CEO tenure is positively associated with higher audit quality, supporting the stewardship and resource dependence theories. However, institutional ownership has a significant negative effect on audit quality, suggesting that higher institutional investor influence may reduce auditor independence. The McFadden R² values range from 16% to 45%, demonstrating that corporate governance variables significantly explain variations in audit quality across firms in Iraq and Qatar.

Conclusion: The findings suggest that stronger governance regulations may be required to mitigate institutional investor influence and enhance audit transparency, particularly in emerging markets.

Downloads

References

Afenya, M. S., Arthur, B., Kwarteng, W., & Kyeremeh, G. (2022). The impact of audit committee characteristics on audit report time lag: Evidence from Ghana. Research Journal of Finance and Accounting, 13(4), 1-11. https://doi.org/10.1080/23311975.2022.2141091

Al-hadal, W. M., & Hashim, H. A. (2022). Impact of audit committee characteristics and external audit quality on firm performance: evidence from India. Corporate Governance: The International Journal of Business in Society, 22(2), 424-445. https://doi.org/10.1108/CG-09-2020-0420

Al-Matari, E. M. (2020). Do characteristics of the board of directors and top executives affect corporate performance in the financial sector? Evidence using stock. Corporate Governance: The International Journal of Business in Society, 20(1), 16-43. https://doi.org/10.1108/CG-11-2018-0358

Alawaqleh, Q. A., Almasria, N. A., & Alsawalhah, J. M. (2021). The effect of the board of directors and CEO on audit quality: Evidence from listed manufacturing firms in Jordan. The Journal of Asian Finance, Economics and Business, 8(2), 243-253. https://www.researchgate.net/publication/353381787_The_Effect_of_Board_of_Directors_and_CEO_on_Audit_Quality_Evidence_from_Listed_Manufacturing_Firms_in_Jordan

Alexeyeva, I. (2023). Board Members’ Outside Directorships and the Demand for Audit Quality: Large Sample Evidence From Private Firms. Journal of Accounting, Auditing & Finance. https://doi.org/10.1177/0148558X231183758

Alia, M. A., Abdeljawad, I., & Yaaqbeh, M. (2020). Depressing earnings management in Palestinian corporations: the role of audit quality, audit committee, and accounting conservatism. International Journal of Revenue Management, 11(3), 213-236. https://doi.org/10.1504/IJRM.2020.109419

Almomani, T., Almomani, M., Obeidat, M., Alathamneh, M., Alrabei, A., Al-Tahrawi, M., & Almajali, D. (2023). Audit committee characteristics and firm performance in Jordan: The moderating effect of the board of directors’ ownership. Uncertain Supply Chain Management, 11(4), 1897-1904. https://doi.org/10.5267/j.uscm.2023.6.002

Borgi, H., Ghardallou, W., & AlZeer, M. (2021). The effect of CEO characteristics on financial reporting timeliness in Saudi Arabia. Accounting, 7(6), 1265-1274. https://doi.org/10.5267/j.ac.2021.4.013

Boshnak, H. A. (2021). The impact of audit committee characteristics on audit quality: Evidence from Saudi Arabia. International Review of Management and Marketing, 11(4), 1. https://doi.org/10.32479/irmm.11437

Dakhli, A., & Mtiraoui, A. (2023). Corporate characteristics, audit quality, and managerial entrenchment during the COVID-19 crisis: Evidence from an emerging country. International Journal of Productivity and Performance Management, 72(4), 1182-1200. https://doi.org/10.1108/IJPPM-07-2021-0401

Hasan, S., Kassim, A. A. M., & Hamid, M. A. A. (2020). The impact of audit quality, audit committee, and financial reporting quality: evidence from Malaysia. International Journal of Economics and Financial Issues, 10(5), 272. https://doi.org/10.32479/ijefi.10136

Islam, M., Slof, J., & Albitar, K. (2023). The mediation effect of audit committee quality and internal audit function quality on the firm size-financial reporting quality nexus. Journal of Applied Accounting Research, 24(5), 839-858. https://doi.org/10.1108/JAAR-06-2022-0153

Jadiyappa, N., Hickman, L. E., Kakani, R. K., & Abidi, Q. (2021). Auditor tenure and audit quality: an investigation of moderating factors prior to the commencement of mandatory rotations in India. Managerial Auditing Journal, 36(5), 724-743. https://doi.org/10.1108/MAJ-12-2020-2957

Kalia, D., Basu, D., & Kundu, S. (2023). Board characteristics and demand for audit quality: A meta-analysis. Asian Review of Accounting, 31(1), 153-175. https://doi.org/10.1108/ARA-05-2022-0121

Kalita, N., & Tiwari, R. K. (2023). Audit committee characteristics, external audit quality, board diversity, and firm performance: evidence from SAARC nation. Journal of Economic and Administrative Sciences. https://doi.org/10.1108/JEAS-08-2023-0235

Kateb, I., Nafti, O., & Salah, N. B. (2023). Impact of corporate governance and audit quality on financial performance: listed vs. unlisted Tunisian companies. International Journal of Managerial and Financial Accounting, 15(2), 185-210. https://doi.org/10.1504/IJMFA.2023.129839

Lutfi, A., Alkilani, S. Z., Saad, M., Alshirah, M. H., Alshirah, A. F., Alrawad, M., & Ramadan, M. H. (2022). The influence of audit committee chair characteristics on financial reporting quality. Journal of Risk and Financial Management, 15(12), 563. https://doi.org/10.3390/jrfm15120563

Mahmoodi, R., Zalaghi, H., & Aflatooni, A. (2023). Corporate Governance Stability And its Impact on the Quality of Accounting Information of Companies Listed on the Iraq Stock Exchange. International Journal of Professional Business Review, 8(5), e01657. https://doi.org/10.26668/businessreview/2023.v8i5.1657

Mardessi, S. M. (2021). The effect of audit committee characteristics on financial reporting quality: The moderating role of audit quality in the Netherlands. Corporate Ownership and Control, 18(3), 19-30. https://doi.org/10.22495/cocv18i3art2

Mardnly, Z., Badran, Z., & Mouselli, S. (2021). Earnings management and audit quality at Damascus securities exchange: does managerial ownership matter? Journal of Financial Reporting and Accounting, 19(5), 725-741. https://doi.org/10.1108/JFRA-06-2020-0162

Mohammadi, S., Saeidi, H., & Naghshbandi, N. (2021). The impact of board and audit committee characteristics on corporate social responsibility: evidence from the Iranian stock exchange. International Journal of Productivity and Performance Management, 70(8), 2207-2236. https://doi.org/10.1108/IJPPM-10-2019-0506

Mollik, A. T., Mir, M., McIver, R., & Bepari, M. K. (2020). Effects of audit quality and audit committee characteristics on earnings management during the global financial crisis-evidence from Australia. Australasian Accounting, Business and Finance Journal, 14(4), 85-115. https://www.researchgate.net/publication/346115494_Effects_of_Audit_Quality_and_Audit_Committee_Characteristics_on_Earnings_Management_During_the_Global_Financial_Crisis_-_Evidence_from_Australia

Musallam, S. R. (2020). Effects of board characteristics, audit committee, and risk management on corporate performance: evidence from Palestinian listed companies. International Journal of Islamic and Middle Eastern Finance and Management, 13(4), 691-706. https://doi.org/10.1108/IMEFM-12-2017-0347

Ngo, D. N. P., & Nguyen, C. V. (2022). Does the CEO’s financial and accounting expertise affect the financial reporting quality? Evidence from an emerging economy. Journal of Financial Reporting and Accounting. https://doi.org/10.1108/JFRA-09-2021-0301

Nguyen, Q. K. (2023). Women in top executive positions, external audit quality, and financial reporting quality: evidence from Vietnam. Journal of Accounting in Emerging Economies. https://doi.org/10.1108/JAEE-03-2023-0059

Paolone, F., Pozzoli, M., Cucari, N., & Bianco, R. (2023). Longer board tenure and audit committee tenure. How do they impact environmental performance? A European study. Corporate Social Responsibility and Environmental Management, 30(1), 358-368. https://doi.org/10.1002/csr.2359

Payne, J. L., & Williamson, R. (2021). An examination of the influence of mutual CFO/audit firm tenure on audit quality. Journal of Accounting and Public Policy, 40(4), 106825. https://doi.org/10.1016/j.jaccpubpol.2021.106825

Phuong, N. T. T., & Hung, D. N. (2020). Board of directors and financial reporting quality in Vietnam-listed companies. International Journal of Financial Research, 11(4), 296-305. https://ideas.repec.org/a/jfr/ijfr11/v11y2020i4p296-305.html

Rahaman, M. M., & Karim, M. R. (2023). How do board features and auditor characteristics shape key audit matter disclosures? Evidence from emerging economies. China Journal of Accounting Research, 16(4), 100331. https://doi.org/10.1016/j.cjar.2023.100331

Rijal, S., & Bakri, A. A. (2023). Effect of auditor specialization, auditor characteristics, board independence on audit quality through intellectual capital: study on service companies. The Es Accounting and Finance, 1(02), 95-103. https://doi.org/10.58812/esaf.v1i02.66

Sadeghi Dehcheshmeh, S., Jafari Dehkordi, H. R., & Banitalebi Dehkordi, B. (2024). Characteristics of corporate governance, audit committee, and audit report lag: A meta-analysis. International Journal of Nonlinear Analysis and Applications. https://ijnaa.semnan.ac.ir/index.php/article_8595.html

Safari Gerayli, M., Rezaei Pitenoei, Y., & Abdollahi, A. (2021). Do audit committee characteristics improve financial reporting quality in emerging markets? Evidence from Iran. Asian Review of Accounting, 29(2), 251-267. https://doi.org/10.1108/ARA-10-2020-0155

Schumann, F., Thun, T. W., Dauth, T., & Zülch, H. (2024). Does top management team diversity affect accounting quality? Empirical evidence from Germany. Journal of Management and Governance, 28(1), 137-175. https://doi.org/10.1007/s10997-023-09668-7

Downloads

Additional Files

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Read Naeem Rashid Al-Bugharbee (Author); Hamzeh Mohammadi Khoshouei (Corresponding Author); Ismael Abbas Manhal Abu-Ragheef, Rahman Saedi (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.